Overall trend of this pair fixes it bearish view for a target of 184.604 and may even tumble up to 182.420 in medium terms.

We now reckon that the bearish patterns have more downside potential and would reveal a medium term downtrend direction.

We sensed some intermediate uptrend so far, hereafter you can have a view on daily charts (the bearish signal spotted out, long put instruments to generate positive cash flows here onwards).

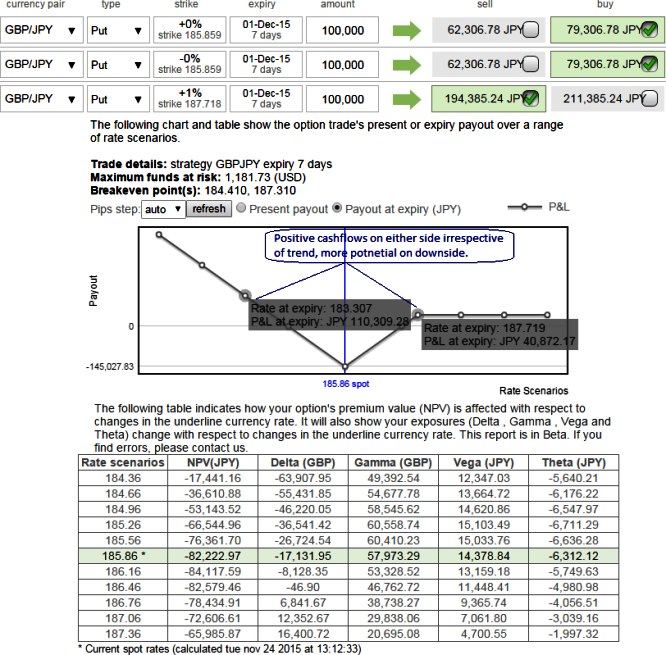

We think arresting this potential downside risks by hedging through Put Ratio back Spread is more effective hedging strategy than any other means.

So, stay firm with longs on 2 lots of At-The-Money -0.50 delta puts would function effectively.

Short 1 lot of ITM put option would generate assured returns on any abrupt rallies, shortly longs on ATM puts are about to function that would take care of potential downswings.

Alternatively, if they wish to short OTM instruments, they sell puts that has delta of less than 0.15. Which means they sell deep Out Of The Money options. The idea behind this trade is that the chance of this option to expire worthless is 85%. (1-0.15 = 0.85 or 85%).

If they want to buy, they buy options that have delta of 0.5 or more. Which means they buy At The Money or slightly In The Money Options.

FxWirePro: GBP/JPY’s weakness to resume –stay short via PRBS to hedge as hard currency to depreciate

Tuesday, November 24, 2015 7:51 AM UTC

Editor's Picks

- Market Data

Most Popular

5

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings