With the below technical reasoning, we recommended arresting potential downside risks of this pair by hedging through Put Ratio back Spread. The short term ITM shorts have already fetched assured gains and were exactly suitable for short term upswings then (with shorter expiries, probably 4-5 days), so thereby premiums of shorts on one lot of (1%) In-The-Money put option can be blocked as a certain yields.

Thereafter, now it's time for longs set up in put back spreads, we expect the underlying currency GBPJPY to make a further move on the downside. So, longs on 2 lots of At-The-Money -0.50 delta puts would function effectively.

How does it favor hedging objective: The short ITM puts funds to the purchase of the greater number of long puts and the position is entered for no cost or a net credit. The delta of combined positions should be around -0.39 with negative theta value. If a disciplined hedger strictly follows all these mathematical computations, then irrespective of market sentiments, one can be rest assured with the riskfree exposures in his foreign trade.

Technical watch:

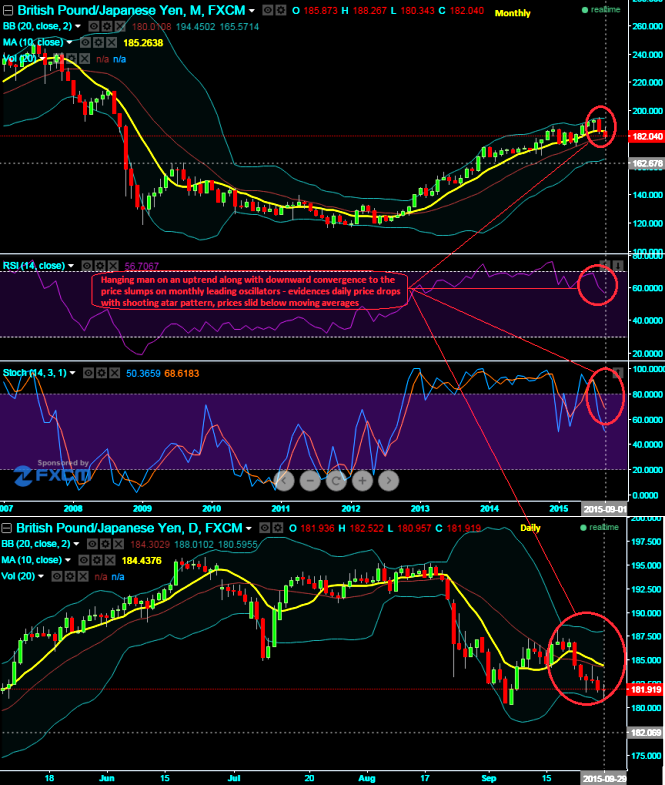

The formation of hanging man pattern candle on peaks of uptrend at around 193.456 levels alerts us the bearish trend on monthly chart. This hanging man followed by two long real body red candles would reveal a medium term downtrend direction. It is important to emphasize that the hanging man pattern is a warning of potential price change, not a signal, in and of itself, to go short.

See daily price effects after above mentioned bearish pattern. Overall pattern on the pair fixes it bearish view for a target of 177.125, if it breaks this level further it may even extend the slumps up to 175 levels. In addition to that huge volumes are popping up to show bearish sentiments, while leading oscillators (RSI & slow stochastic) show convergence with dipping prices at current levels. RSI is currently trending at 58.2336, while %D crossover above 80 levels signifies the selling momentum is intensifying.

FxWirePro: GBP/JPY put backspreads capitalizing upon hanging man formation

Tuesday, September 29, 2015 9:54 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate