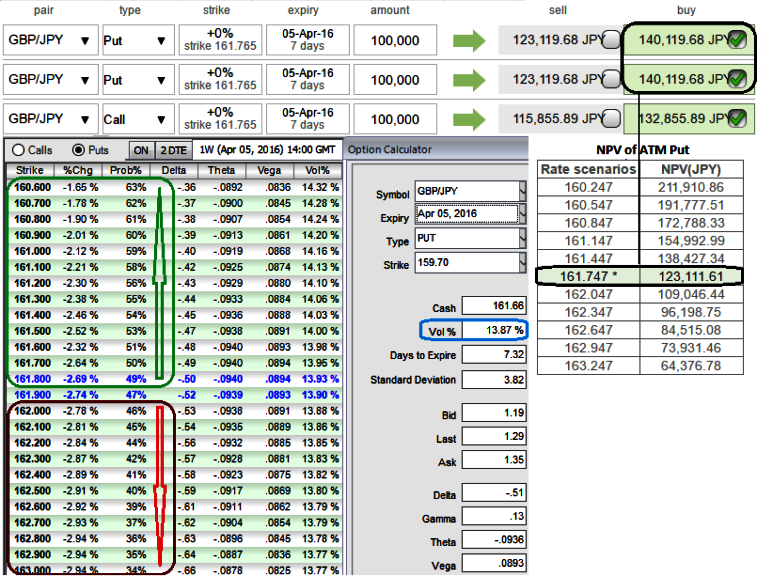

Let's have a glance on the implied volatilities of GBPJPY ATM puts of 1W expiries that are the highest in G7 currency segment in OTC markets, 13.87% ahead of series data events in this week.

Japanese industrial production scheduled for tomorrow, BoE governor Carney's speech, current account & GDP QoQ on Thursday and manufacturing PMI on Friday is lined up.

In FX OTC of this pair, as you can make out the premiums of 1W ATM puts are trading 13.8% more than NPV, whereas IVs are also at 13.87%, hence we reckon that these derivative instruments have fairly been priced in.

Technical glimpse: In spot FX of GBPJPY, the pair has been slipping through lower Bollinger band as and when it bounces to touch 7EMA, this has been happening right from 184.500 levels, for more technical observation please follow below link.

"What is weighing on the pound's slumps?" - the answer lies in nothing other than the expectations from BoE to deliver monetary policy but that has remained unchanged but the chances for lower interest rates in 2016 has grown up to 23%, an increase from the February survey that had placed the odds at only 10%, above all lingering Brexit probabilities add an extra pressure on sterling's depreciation.

Elsewhere, in FX option markets have been factoring GBP depreciation by 20% is divulging the weakness in this pair, and the probabilities of OTM strikes expiring in the money have been higher as comparatively to the ITM strikes (see probability column in diagram)

It means the market thinks the price has potential for large movement in downward direction.

Since, the option premiums are fairly priced, we advocate the suitable strategy to hedge the FX risks of this pair.

Buy 1M at the money 0.51 delta call option and simultaneously go long in 2 lots of 2M at the money -0.49 delta put options.

The strategy is more of customized version combination and more bearish version of the common straddle.

Returns: Huge profits achievable with the strip strategy when the underlying currency exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move.

Hence, any hedger or trader who believes the underlying currency is more likely to plunge downside can go for this strategy.

Cost of hedging would be Net Premium Paid + brokerage/commission paid.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential