Amid today’s rallies, the sterling weakened considerably in March month series especially after media reports that Prime Minister Theresa May would not be able to gain sufficient votes and that her withdrawal agreement intentions would once again be rejected by the House of Commons this week.

Quite a few market participants had clearly hoped that the Brexiteers would vote for the plan for fear that Brexit would otherwise be called off completely. However, that does not seem to be the case so that a postponement of the exit date seems increasingly likely.

Nevertheless, until that too has all been sorted out we would remain cautious as a GBP investor and stay directionally hedged ahead of UK’s GDP, manufacturing data and budget on the UK side and BoJ’s monetary policy that are scheduled for this week.

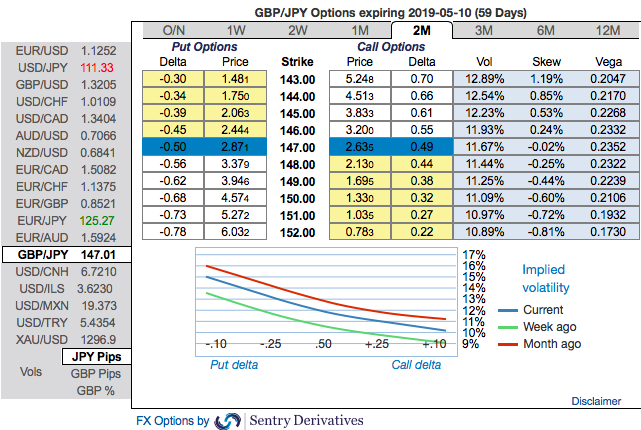

GBPJPY has rallied from the lows of 130.699 to the current 146.635 levels, which must have been factored in our previous strategy through the short leg of OTM puts. Yes, We have advocated put ratio back spreads of diagonal tenors a fortnight ago that comprised of shorts in 2w (1%) OTM put option (position seemed when the underlying spot goes either sideways or spikes mildly), simultaneously, longs in 2 lots of long in 2m ATM -0.49 vega put options.

As the underlying spot FX has spiked considerably as stated above, the writer of the short legs can rest assured with initial premiums received.

Well, on the flip side,

The rationale for long legs in PRBS: The positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes up to 143 levels (refer above nutshells evidencing IV skews).

Accordingly, long positions in the diagonal put ratio back spreads (PRBS)have been advocated on the hedging grounds. Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on abrupt and momentary price rallies, simultaneously, bidding theta shorts in short run, on the flip side, 2m skews to optimally utilize vega longs.

The volatility impact: Please be noted that IVs of GBPJPY display the highest number (11.69%) among the entire G10 FX universe (trending between 10.89% - 12.89%). Hence, vega long put is most likely to perform decently capitalizing on the rising mode of IVs.

The traders tend to perceive these trades as a bear strategy because it deploys more puts. But actually, it is a volatility strategy.

Hence, entering the position when implied volatility is high and anticipating for the inevitable adjustment is a wise thing, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a “price neutral” approach to options and one that makes a lot of sense.

Given the condition that IVs keep rising and if GBPJPY spot keeps dipping, then the vega longs would add handsome option’s premiums to the price of such puts correspondingly, these derivatives instruments target further bearishness of this pair. Courtesy: Sentrix and Commerzbank

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing 145 (which is highly bullish), while hourly JPY spot index was at -81 (bearish) while articulating (at 08:48 GMT).

For more details on the index, please refer below weblink:http://www.fxwirepro.com/currencyindex

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential