In our previous write-up, we have already stated in the technical study of GBPJPY that the pair is mounting with bearish sentiments. We kept reiterating ever since it has broken wedge baseline and frequent occurrence of some bearish pattern candlesticks that have evidenced steep price slumps already and still signal extreme weakness further. Both momentum and trend indicators are also in conformity to this bearish stance. Accordingly, we’ve given next bearish targets upto 142 levels in the medium run.

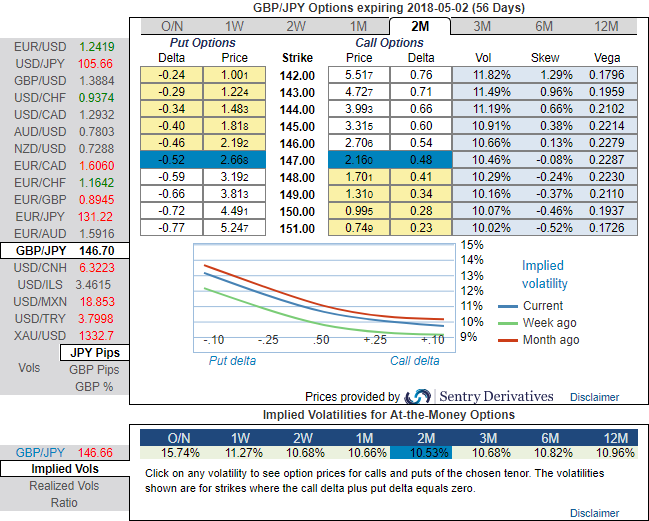

This analysis is in tandem with the OTC indications of 2m tenors. Please be noted that the positively skewed IVs of GBPJPY of 2m tenors signify the hedgers’ interests in OTM put strikes (upto 142 levels) and isn’t this a luring factor for a shrewd bear. While 2w/2m IVs of ATM contracts are trending above 10.68% and 10.53% respectively that are the suitable combinations for diagonal put ratio spreads.

Because the higher IVs with well-adjusted positive skewness signify the hedgers’ interest for both OTM call/put strikes. In usual circumstances, long option position needs higher IVs for significant change in vega. Hence, we capitalize on buzzing IVs in 2m tenor for long leg and improve odds on options below strategy.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility. Thus, ATM strikes are perceived to be more conducive than the OTMs.

Further GBPJPY upswings and/or weakness suggest building directional strategies as given below and volatility patterns at the same time.

1) In order to mitigate the mounting downside risks and keep them on the check, we advocate adding longs in 2 lots of ATM -0.49 delta puts of 2m tenor while writing 1 lot of 2% OTM put of 2w tenor.

Contemplating IV skewness and ongoing technical trend, we foresee the value of ATM options would likely rise significantly as the IVs seem to be favoring long legs of ATM strikes.

2) Dubious and risks averse traders, we advocate buying GBPJPY – USDJPY 1Y ATM straddle spread with equal JPY vega.

3) Alternatively, on hedging grounds, we advocate shorting futures contracts of near-month tenors as the underlying spot FX likely to target southwards 144 levels in the near run and 142 levels in the medium run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned into -19 (which is mildly bearish), while hourly JPY spot index was at shy above -2 (neutral) while articulating (at 06:17 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty