The yen is pressurized against the US dollar, the pair spiked to the highs of 102.784, settled to trade at 102.040 levels currently, trimming its advance this year to about 17 percent. While GBPJPY is no exception, has spiked 133.261 levels.

The BOJ faced a backlash after first deploying negative rates in January. Kuroda recently acknowledged that negative rates had cut into financial institutions’ profits by driving long-term yields lower while pointing out borrowing costs for businesses and consumers had also fallen.

BOJ policy outlook in a nutshell:

Policy rate: -0.1%

JGB purchase: 80 trillion yen

ETF purchase: 6 trillion yen

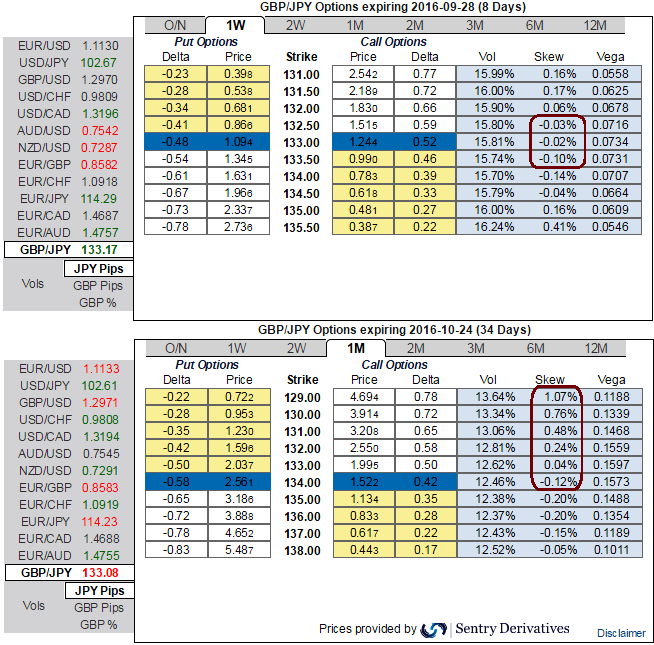

GBPJPY OTC Outlook:

1w IV skews are equally interested in both OTM calls and OTM puts, while 1m skews signify the hedging interests in OTM put strikes.

Usually, pondering over the option sensitivity tool, IVs indications are puzzling in 1w tenors but short upside sentiments could be optimally tackled and attained the trade or investment objectives via theta options of shorter tenors.

The long term bears of this pair can load up shorts in underlying pair with longer tenors to arrest major downtrend as the selling momentum is intensified by leading oscillators with mammoth volumes.

So it is advisable to initiate Diagonal Credit Put Spread (DCPS) in order to tackle both short-term upswings and major downtrend.

For the ease of understanding, we’ve just considered this option strategy with shorts in 1W (1%) ITM put with positive theta or closer to zero while buying 1M (0.5%) OTM put option; the strategy could be executed at net credit.

Theta on short side measures time decay in your options premium value per day which means the premiums on short leg today is worth more than over every time break even if the underlying spot doesn’t move anywhere, all else been equal, the option premium should be waning out. This would be the case even when underlying spot never goes up but remains in sideways.

Option sellers can reap the benefits of a high Theta near expiry by selling short-dated ATM options with the expectation of little to almost no market movement.

Thereafter, the major trend prolongs to evidence further slumps, narrowed OTM longs would mitigate downside risks on the other hand as the holder of such option would be having right sell at predetermined strikes.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays