GBPJPY dipped from the highs of 147.987 levels to the current 144.947 levels in last weeks (refer above chart). Thereby, bears of this pair have resumed back their business. We overtly stated about this bearish trend of this pair coupled by technical indicators. For more insights on this, please go through below weblink:

The genesis of GBP’s slide in April (GBP is the worst performing G10 currency since the dollar began to rally in mid-April) was a fairly prosaic economic one, namely the belated recognition by the BoE and investors that the economy had barely grown in 1Q and that monetary policy needed to become more data-dependent as a result. As BoE is scheduled its monetary policy meeting tomorrow, GBP bearish sentiments are lingering on the delayed rate hikes until much later in 2018 as core CPI continues to moderate and wages remain sticky below 3%.

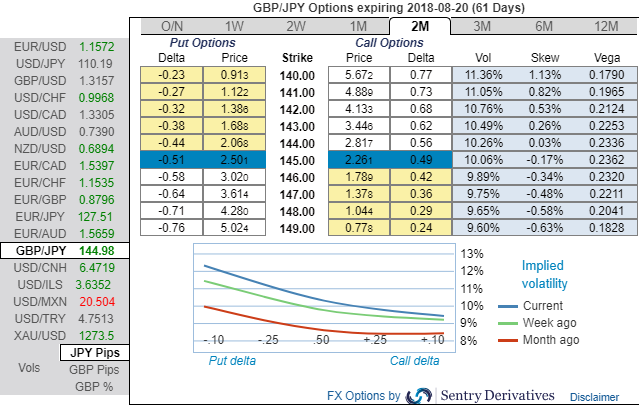

OTC updates: The OTC indications of GBPJPY are also substantiating the above-stated bearish stances if you glance at the positively skewed IVs of GBPJPY of 2m tenors signify the mounting hedgers’ interests in OTM put strikes (bids upto 140 levels, see above nutshell showing IV skews) and isn’t this a luring factor for a shrewd bear. While 2w/2m IVs of ATM contracts are trending between 9.42% - 11.23 % that are the suitable combinations for diagonal ratio spreads structures.

Because the higher IVs with well-adjusted positive skewness signify the hedgers’ interest for both OTM call/put strikes. In usual circumstances, long option position needs higher IVs for significant change in vega. Hence, we capitalize on buzzing IVs in 2m tenor for long leg and improve odds on options below strategy.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility. Thus, ATM strikes are perceived to be more conducive than the OTMs.

Options Strategies: The lingering concerns on any further GBPJPY weakness suggest customizing directional strategies as given below and volatility patterns at the same time.

In order to mitigate the mounting downside risks and keep them on the check, we advocate adding longs in 2 lots of (1%) OTM -0.49 delta puts of 2m tenor while writing 1 lot of 1% ITM put of 1m tenor. Payoff structure of this strategy has been exponential as the underlying spot FX keeps dipping.

Contemplating IV skewness and ongoing technical trend, we foresee the value of ATM options would likely rise significantly as the IVs seem to be favoring long legs of ATM strikes.

Writing 1m (1%) in the money put with positive theta snaps decisive rallies, short legs on ITM puts would go worthless considering time decay advantage. Simultaneously, we uphold 2 lots of longs in 3m 1% OTM puts, the structure could be constructed either at net debit.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -22 (which is bearish), while hourly JPY spot index was at 158 (extremely bullish) while articulating (at 09:46 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady