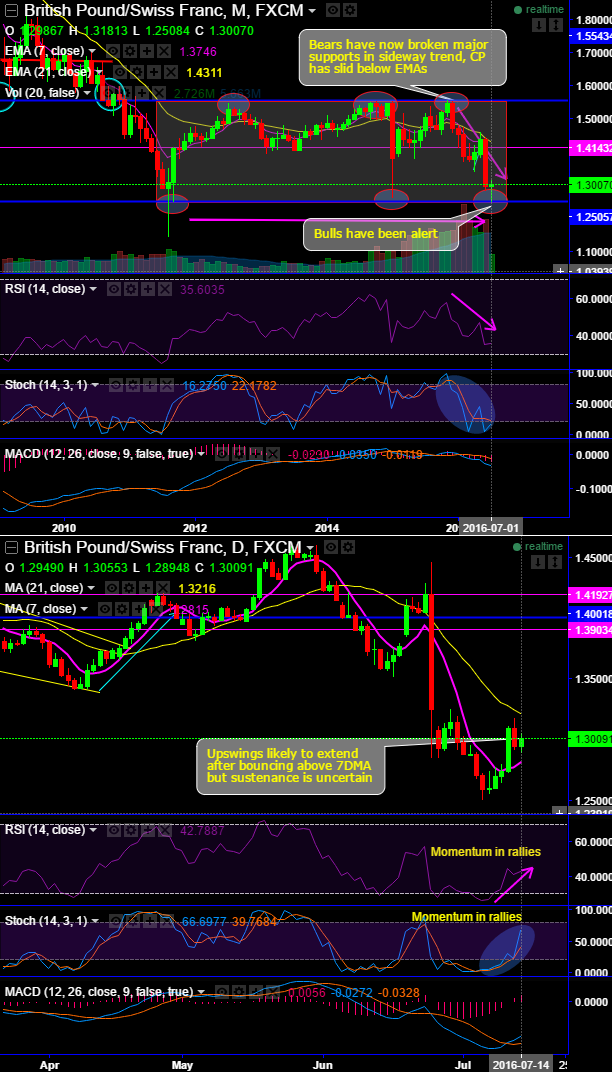

This pair has been oscillating between the range (upper bracket of 1.5572 and lower bracket of 1.2505 levels.

Currently, the bulls of this pair seem to be alert the moment when it hits lower range of 1.2505 levels, even though breaking below the major supports at 1.4143 levels.

While the current prices on daily charts have bounced above 7DMA curves, and for now it is most likely targeting to hit 1.3216 resistance levels (21DMA).

This interim bullish environment is also substantiated by leading oscillators, RSI converges to the rising prices on daily graphs.

While the stochastic oscillator also signals bullish momentum as there is a clear %K line crossover right from oversold territory, thereby, we can expect the swings to remain back in range on weekly plotting.

GBPCHF would be slightly bullish bias to bring in a choppy range now but any disruption from BoE today may also continue the slumps in the major trend. Well, in order to tame these puzzling swings we reckon below option strategy is more useful for speculators.

Option-trade set up: Credit Put Spreads (CPS)

Since 1W ATM IV of this pair is on a lower side, at around 17.11%, we see opportunities in shorting in the money put options with very narrowed expiries (per say 3d expiries), going long in 1M (1%) out-of-the-money put.

This strategy is typically employed when the options trader expects either slightly bullish environment or sideways in the short run but certainly bearish in the long run.

But on speculative grounds, as there is intraday buying trend is on with positive technical indications, we see buying opportunities in binary calls as well for targets of 20-25 pips.