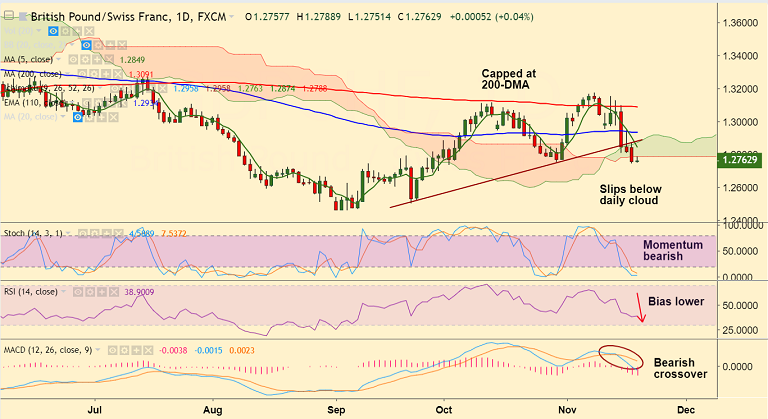

GBP/CHF chart on Trading View used for analysis

- GBP/CHF edges lower, breaks below daily cloud, we see scope for further weakness.

- Brexit news will continue to remain a key driver impacting risk flows and demand for CHF.

- UK Prime Minister Theresa May is still trying to desperately force through a Brexit compromise amidst a rising opposition from within her own political party.

- Expect Brexit headlines to continue twisting sentiment towards the bearish side.

- Technical studies are also bearish, Stochs and RSI are sharply lower and MACD shows bearish crossover.

- Break below cloud has raised scope for further weakness, drag till 1.25 now likely.

Support levels - 1.2743 (Nov 19 low), 1.2592 (Aug 15 low), 1.2501 (Sept 21 low)

Resistance levels - 1.2788 (cloud bottom), 1.2849 (5-DMA), 1.2934 (110-EMA)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-GBP-CHF-Trade-Idea-1460485) has hit TP1.

Recommendation: Book partial profits, hold for further weakness.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty