Dear readers, let's begin with this hedging formulation after a brief glance over our previous post on the trend analysis of this pair.

Technically, bull swings taking support at 50% fibo retracements form bullish candle with big real body on monthly terms, previous intermediate downtrend seems to have reversed but volumes yet to confirm.

So, we would like you to understand the mystification of these puzzling swings revolving in this pair.

Currently, it looks like signs of the uptrend are back again, which in turn these price gains could be deemed as recovery swings.

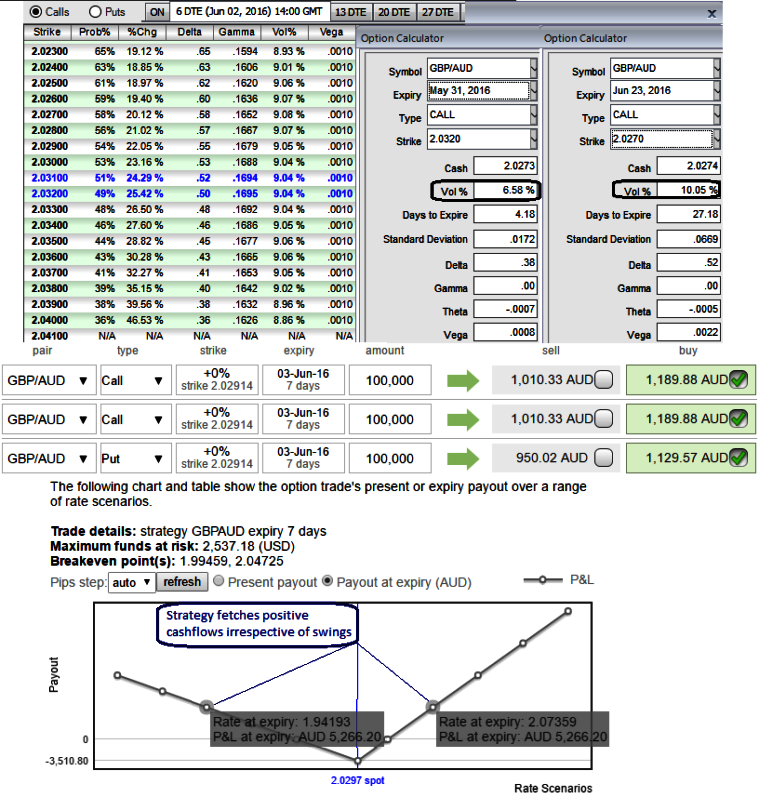

In sensitivity table, the delta is progressively growing along with gamma numbers as this Option Greek is an indicators of rate of change in delta.

So these numbers are steady even if you shift 1% on either side of the spot, the steadiness is also indicated by constant rise in IVs and vega.

Hedging Perspectives: Option straps (GBPAUD)

Subsequently, those who wants deploy this strategy in the hedging mindset, the risks of FX portfolios from ongoing bullish trend and any abrupt slumps could be mitigated through these positions in the strategy, and can concentrate in their core business areas.

We recommend building portfolio with longs positions in 2 lots of 0.50 delta ATM calls with 1M expiry and 1 lot of -0.49 delta ATM puts of 2w expiries. (For demonstrated purpose only we’ve used identical expiries in the diagram).

Hence, this GBPAUD option strips strategy should take care of ongoing upswings and abrupt downswings and yields handsome returns.

One can observe in the diagram rising delta effects upon rising exchange rate GBPAUD and shrinking as the underlying spot rate dips which means our underlying outrights are fairly hedged against irrespective of rate scenarios.

Delta of far OTM options is very small which is why we’ve chosen ATM instrument on call. 1-point movement in underlying pair will not have much effect on the option premium.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge