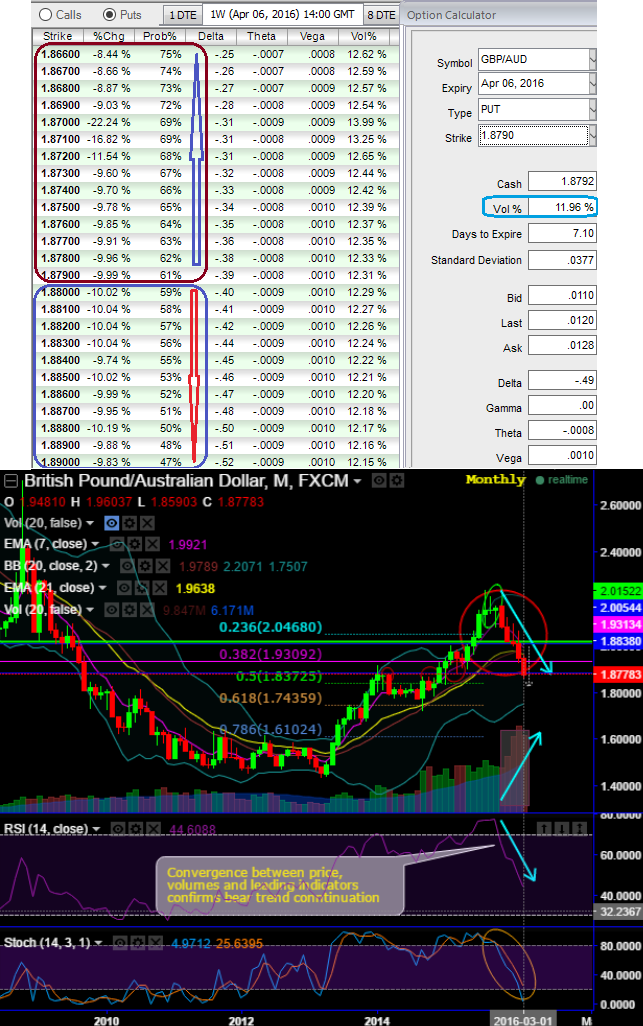

ATM IVs of 1W expiries are almost shy below 12%, and 11.70% for 1M tenor.

With the momentum in long term bear trend being intensified, technically the pair has broken crucial supports,

If you have to evaluate the ATM IVs with the monthly technical chart, the prevailing bearish swings have convincingly shown their effects.

Aussie dollar against sterling has been gaining consistently (so far 3.48% in this month while articulating) as both all technical and fundamental environments are still signalling selling sentiments in GBPAUD.

If IV is high, it means the market thinks the price has potential for large movement trend direction. In GBPAUD case, as you can probably guess where would spot FX head towards considering the IVs and technical indications shown in the diagram.

As IV increases along with the anticipated direction in trend (which is happening in GBPAUD case) and if you are holding a put option, that's conducive for put option holder.

Because your options with a higher IV cost more which means more positive cash inflow is likley.

Sensitivity tool: In addition to that, as shown in the diagram, if you have to optimise these favourable vols, consider the premiums with probabilistic numbers in distinctive scenarios of OTM strikes.

(At spot FX 1.8796, as it travels towards OTM strikes (see through OTM strikes and their probability numbers), this means more chances of expiring in the money and huge changes in premiums, so these options pricing seems reasonable, but same is not the case with lower strikes.

Hence, the OTM options pricing seems reasonable in bearish hedging strategies, which means more likelihood of these puts expiring in the money.

Hence, we recommend initiating longs in 1M (1%) OTM -0.37 delta put, 1 lot of 2W ATM -0.49 delta put and simultaneously short 1 lot of 1W (1%) ITM put in the ratio of 2:1.

The upper strike short puts finance the purchase of the greater number of long calls and the position is entered for reduced cost.