Macro and geopolitical outlook:

In the UK, Macroeconomic fundamentals and political factors continue to dominate the headlines, with further signs that the UK and the EU are entering the Brexit negotiations some distance apart.

PM May accuses the EU of interfering with the UK election, UK Prime Minister May’s meeting with French President Macron today will ensure that Brexit concerns remain at the centre of attention.

July services PMIs for the major economies will be watched for signs that activity slowed last month. The Eurozone outturn is unlikely to vary much from last week’s initial number. However, the UK data and US ISM non-manufacturing reading will be of more interest.

The other UK PMI data for July have been mixed as manufacturing was a touch lower than forecast (actual 54 against forecasts at 54.2) but construction PMIs surprised significantly on the upside (actual 55.8 versus 52.8 and previous 53.1). We expect the headline services index to have declined modestly to 54.6 from 55.1 in June.

Sterling immediately spiked higher following the Bank of England interest rate hike but the pound soon slipped back below its pre-announcement levels. It seems markets were unconvinced by the BoE’s relatively hawkish policy guidance, with Brexit uncertainties in particular, likely to have weighed on the currency. Brexit will remain in focus today with the UK PM due to meet the French leader. Today’s UK data will probably take a back seat unless the services PMI posts a significant surprise.

On the flip side, Australia got a softer start to Q1 GDP accounting, Australia’s trade balance surged to A$1.87 billion on MoM, though the terms of trade release confirmed it was mainly a price, rather than volume story.

Well, all these macros standpoints could propel GBPAUD either on upswings or downswings but with slightly biased southwards.

Hedging Framework:

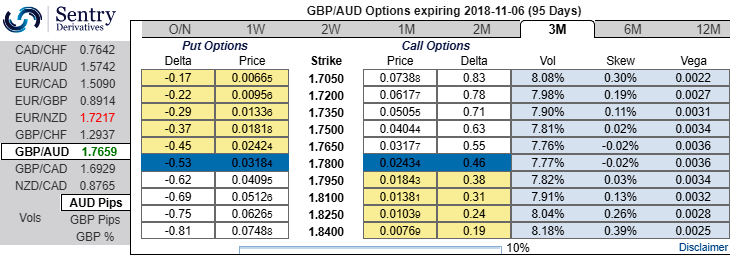

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

The execution: Initiate long in GBPAUD 3M at the money delta put, long 3M at the money delta call and simultaneously, Short theta in 1m (1.5%) out of the money call with positive theta or closer to zero.

Rationale: Contemplating 3m IV skews that are well balanced on either side (positively skews on both OTM calls and OTM puts), we reckon that the Delta instruments are conducive to monitor directional risk so as to be aware that how much of option’s value would increase or diminish as the underlying market moves as this option tool measures the value of an option as the underlying spot FX moves. Well, a higher (absolute) Delta value is desirable on the long leg in the above-stated strategy. Whereas, the Theta is positive on the short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry).

We reiterate, in the prevailing puzzled environment you could observe that the momentary bulls of GBPAUD have currently been trading in non-directionally but with some bearish pressures. Hence, we advocate the above hedging strategy with the cost-effectiveness that could hedge regardless of the swings on either side.

Let’s glance at the FxWirePro’s Currency Strength Index: FxWirePro's hourly AUD spot index is flashing -60 (which is bearish), while hourly USD spot index was at shy above 166 (highly bullish) at 07:49 GMT. For more details on the index, please refer below weblink:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data