Sterling was able to retrace the losses it had accumulated during the course of yesterday almost in their entirety but was unable to appreciate significantly beyond that.

Please be noted that GBPUSD and EURGBP pairs flash implied volatility (IVs) numbers at 12.5% and 11.5% respectively, which are the highest among the G10 FX space (refer above nutshells).

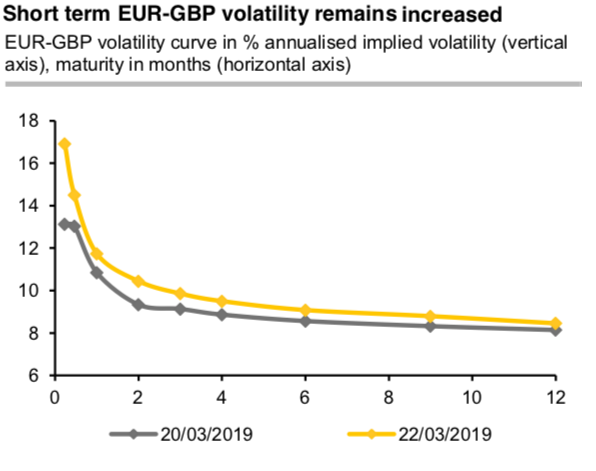

The IVs at the short end did not ease at all but instead rose further (refer 1st chart). That does not surprise as the market never believed in a no deal Brexit on 29th March in the first place otherwise the still relatively high GBP levels would be completely unjustifiable.

Instead, the FX market is now finally in a position to allocate a clear date to the Brexit risks, we will finally know where we stand within the next three weeks.

This realization had considerable effects on the options market: EURGBP risk reversals, which represent the cost differential between hedging against a weaker or stronger pound shot up significantly yesterday across all tenors (refer 2nd chart). That means the FX market clearly now sees a higher likelihood of Sterling collapsing, even if the spot rate is not yet reflecting an increased no deal risk.

Currency Strength Index: FxWirePro's hourly GBP spot index turns -21 (which is mildly bearish), while hourly EUR spot index was at -62 (bearish) at 13:05 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms