The United Kingdom has got the new Prime Minister, Boris Johnson is taking office amid geopolitical turmoil. As the result was generally expected the reaction in the GBP exchange rates was quite modest. And actually, things are happening on the options markets anyway, which is due to the continued high uncertainty regarding the Brexit process.

The Commerzbank’s UK expert Peter Dixon foresees some possible scenarios for the date when the deadline expires on 31st October, the day when the UK is due to leave the EU. Simply due to the numerous possible scenarios the market is likely to struggle to price in one of them with a sufficiently high likelihood. That means that regardless of the scenario that emerges in the end, a significant share of the market is likely to react with surprise. That increases the likelihood of strong and abrupt moves in the GBP exchange rates.

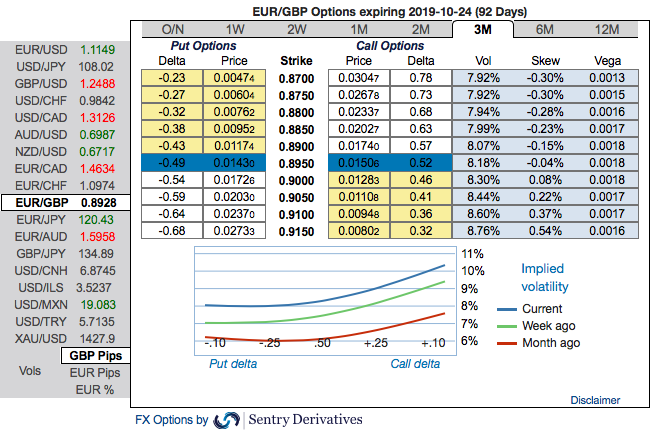

Of course, certain tendencies are nonetheless discernible: the recent rise in premiums for a collapse in GBP for the 3-month horizon suggests that the market is increasingly expecting a disorderly Brexit at the end of October. However, what is interesting is that the premiums for the 6-12 month horizon remain on higher levels.

That means: the market sees a higher risk for significant Sterling depreciation beyond the Brexit deadline, which might suggest that it expects a further extension of article 50 and thus a no-deal Brexit at a later stage. In other words: even if we now have certainty about who will lead the new government in the UK, still nothing remains certain as regards Brexit.

Bullish neutral risk reversals of EURGBP have been observed to the broader bullish risk outlook in the FX OTC markets, this is interpreted as the hedgers are still keen on bullish risks but with mild downside risk sentiment in the near-term, while the pair displays 6.49-6.82% of IVs.

While positively skewed IVs of 3m EURGBP options have been balanced on either side, bids for both OTM calls and OTM puts. This is conducive for options holders of both OTM call and put options.

While EURGBP risk reversals of the existing bullish setup remain intact, even if you see any abrupt negative risk reversal numbers, it should not be perceived as the bearish scenario changer. Courtesy: Sentrix, Saxo & Commerzbank

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts