The underperformance of CHF in 2H’17 and continued through Q1’2018 has been the product of momentary, and potentially mean-reverting, capital outflows, most notably widespread speculative selling of CHF from EUR bulls who regard the franc as nothing more than the anti-euro.

While the capital account recycling of Switzerland’s still massive current account surplus (10% of GDP, 3x the Euro area’s surplus) was expected to be temporarily assisted by a range of second-order, pent-up capital outflows from Switzerland as EUR-centric risk subsided.

The Aussie remains pricey compared to short-term fair value estimates. Yield differentials along the curve continue to move steadily in the US dollar’s favor, but the more notable move in recent weeks is the slide in commodity prices, including a 20% drop in spot iron ore in March. Optimism over global growth is being challenged by US-driven trade tensions which pose downside risks to global trade volumes and AUD. But with the sentiment on the US dollar lukewarm, the pressure on AUD is mostly via crosses.

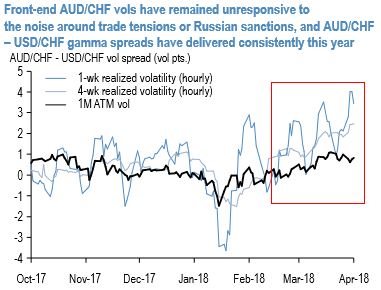

Hence, on the pocket of FX gamma that we like owning after events this week is AUDCHF. The commotion in the Swiss franc after news of the Russian sanctions broke and prompted speculation of Russian liquidation of Swiss assets created a typically sharp CHF weakness which may or may not have run its course.

But AUDCHF gamma outperformance dates back even further when gyrations in AUD in response to trade headlines/SPX swings kept realized vols persistently elevated even as 1M ATMs stubbornly traded 2-3% pts. under. Put differently, AUD vs. CHF correlations have under-realized implied expectations to the tune of 20-25% pts. over the past month, and the traditionally opposite risk betas of the two currencies provides encouragement that the de-coupling can continue even if a strong earnings season provides a tailwind for equity markets.

1M 30D AUD calls/CHF puts that form the trough of the AUDCHF vol surface and trade 0.20 pts. under ATMs are our preferred options to buy; owning the weak side of the skew (CHF puts) has systematically beaten CHF calls across CHF pairs, and could well be in play over the next few weeks if the mix of stronger equities and lingering CHF liquidation flows push AUDCHF higher.

We fund this by selling 1M 30D USD puts/CHF calls, which earn smile theta by selling the strong side of the skew, where a range-bound USD has tamed realized vol and punitive negative carry appears to be dis-incentivizing option purchases from the levered investor community and keeping implied vols in check. The resulting gamma spread has been a one-way performer this year (refer above chart). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing -130 (which is bearish), while hourly CHF spot index was at -71 (bearish) and USD at 48 (bullish), while articulating (at 07:21 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One