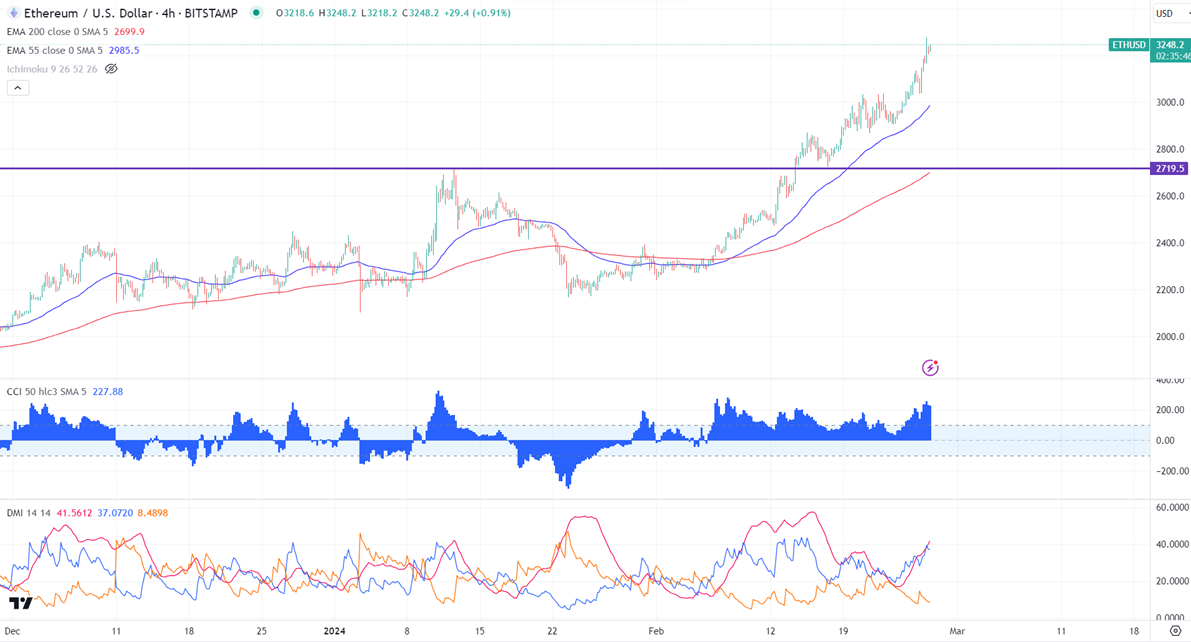

ETHUSD trading higher above $3200 following in the footsteps of BTC. It hit a high of $3275 yesterday and is currently trading around $3259..

According to data from L2Beat, ETH layer2 DeFi Total value locked (TVL) surged more than 9% the previous week, hitting a new high of $29.42 billion. The recent Dencun upgrade will significantly reduce the gas fees and support ETH at lower levels.

The intraday bullishness is possible if it holds above $3200. On the higher side, the near-term resistance is $3300. Any significant jump above the target of $3550/$4000. Significant bullish continuation only above $3555.

The immediate support is around $3150. Any intraday break below will drag the pair to $3080/$2975/$2870. Any breach below $2700 confirms bearish continuation. A dip to $2500/$2470 is possible. A violation below $2100 will drag the Ethereum to $1870.

It is good to buy on dips around $3115-20 with SL around $2975 for TP of $3550/$4000.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary