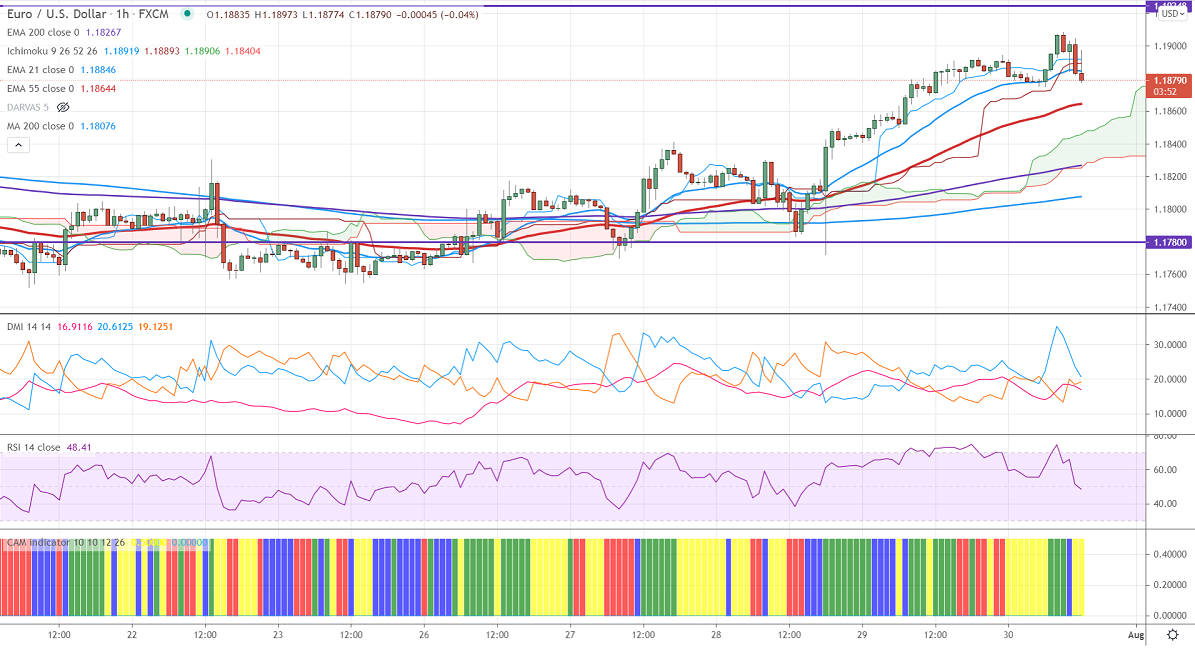

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 1.18919

Kijun-Sen- 1.18893

EURUSD bounced above the 1.1900 level after upbeat Eurozone GDP data. It came at 2% in the three months to June compared to a forecast of 1.5%. While US Personal consumption expenditure rose by 0.7% less than anticipated. The US 10-year yield has shown a minor pullback after US PCE data. The surge in delta variant coronavirus across the globe is preventing the US dollar from further fall. The pair hits an intraday low of 1.18774 and is currently trading around 1.18784.

Technical:

On the higher side, near-term resistance is around 1.1920 and any convincing breach above will take to the next level 1.19655/1.200. The pair's near-term support is at 1.1860, break below targets 1.1825/1.1780.

Indicator (1-hour chart)

CAM indicator-Neutral

Directional movement index – neutral

It is good to buy on dips around 1.1838-40 with SL around 1.1790 for the TP of 1.2000.