- EUR/USD has shown a huge selling yesterday of more than 100 pips on account of dovish ECB monetary policy meeting. The pair broken major support of 1.21500 and declined till 1.20648 at the time of writing. The slightly weaker than expected French GPD and also added pressure to price. US 10 year bond yield declines slightly after hitting high of 3.04%. The pair recovered slightly and is currently trading around 1.20850.

- ECB President has kept its interest rates and forward guidance unchanged. Mr Draghi said that that the Governing council didn’t even discuss monetary policy as more time was needed to discuss about the slight slowdown in Eurozone growth in Q1. The change in forward guidance was expected to happen only in Jul of this year instead of Jun.

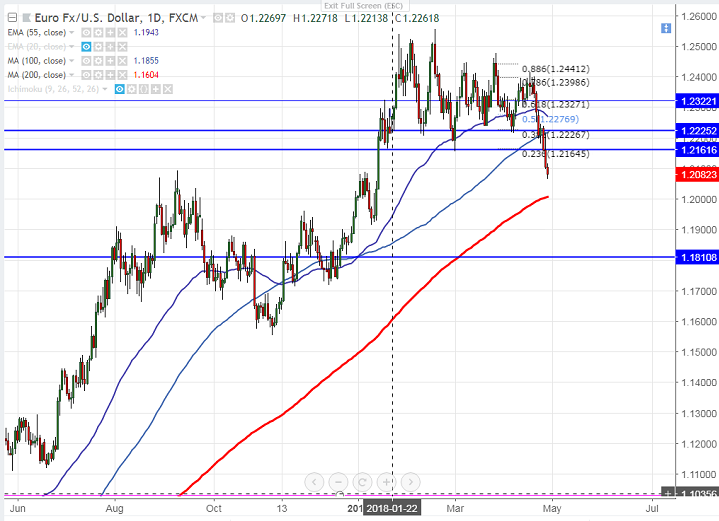

- The pair is facing major near term support is around 1.2050 and any break below will drag the pair down till 1.2000/1.1945

- On the higher side, near term resistance is around 1.2150 and any convincing break above will take the pair to next level till 1.2245/1.2290.Major bullishness only above 1.2320.

It is good to sell on rallies around 1.2150 with SL around 1.2210 for the TP of 1.2055/1.2000.

Resistance

R1-1.2150

R2 –1.2210

R3- 1.2250

Support

S1-1.2050

S2-1.2000

S3- 1.1945