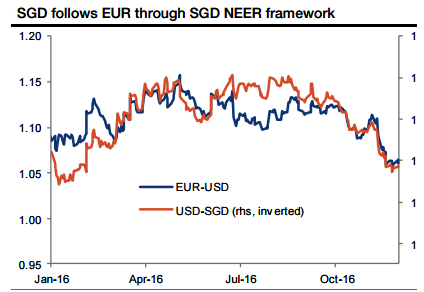

The SGD trades with a very strong correlation to the overall dollar cycle. It has been tightly linked to the EURUSD in the past year and the relationship should hold going forward given the SGD NEER framework (see above graph).

Low implied volatility within EM: The SGD has one of lowest implied vols in EM (3m implied volatility at 6.7%, against 10.0% for the EURUSD), making it relatively cheap to express a directional USD view through options. We expect overall EM currency volatility to increase in coming months alongside a stronger dollar.

Well, overall the dollar also remained largely cushioned by rising U.S. government bond yields and the dollar gaining traction towards (below 1.05 during Q1’2017) on account of three fundamental factors.

Firstly, worries that the OPEC-inspired higher oil price will generate additional US inflation and hence further Fed hikes, Secondly, the hopes of ramped up fiscal stimulus once Donald Trump becomes president, lastly, favorable economic data flashes.

As a result, we’re now seeing turbulence in euro’s OTC markets, the implied volatility of ATM contracts for 1w and near month expiries of EURUSD are spiking sky-rocketed at around 17.75% and 10.85% respectively which is the highest among G7 currency space.

While delta risk reversals flashing up negative numbers that signify the long-term robust bearish sentiments.

Tracking EUR to parity In Q1’17, we expect the EURUSD to break through the technical support at 1.05 and to reach parity (Trumped up changes). We previously provided trade recommendations for a significantly lower EURUSD.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed