EURUSD targets were quite conservative in view of the broader support USD was expected to receive from a more assertive Fed, albeit the risks to the end-2018 projection of 1.23 were firm to an overshot. Already from the middle of December, it was apparent that the bullish risk scenario for EUR was morphing into the central scenario as the economy continued to shoot out the lights.

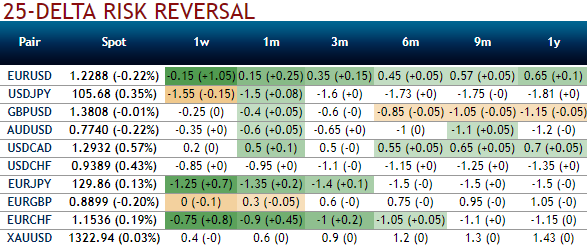

Please be noted that the above nutshell showing 3m IVs of this pair that has been neutral. Implied volatilities have been extremely lower among the G7 FX space and you could also make out that there has been mounting hedging sentiments for bullish risks (the positive change in risk reversals across all the tenors and with the positive shift in bearish hedging sentiments are substantiated by positively skewed IVs).

Well, contemplating these OTC indications, using collar spread options strategy, the investor gets to earn a premium on writing overpriced puts capitalizing on lower IVs, simultaneously add a protective at the money call option bidding positive RRs.

This is a suitable strategy where the aggressively bullish investor sells out of the money puts against a holding of the underlying spot outrights but keeps upside risks on the check.

Buying ITM call options gives you high positive delta, unlimited profit potential, and therefore if you are expecting the underlying FX pair to spike up ascetically with the possibility of going much higher, you would buy ITM calls.

On the flip side, shorting OTM puts fetches you a certain return but limited profit potential as long as the underlying spot FX remain above the strike price so if you are expecting the underlying pair to remain more or less sideways or upwards just a little bit, you would do this instead.

Currency Strength Index: FxWirePro's hourly EUR spot index is displaying shy above 112 levels (which is highly bullish). While hourly USD spot index was inching towards -82 (bearish) while articulating (at 11:04 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand