The EURUSD exchange rate was moving in a tight trading range yesterday. However, this was less due to the fact that there was a lack of momentum but the fact that USD strength and EUR strength were roughly evenly balanced. EUR benefitted from strong sentiment indicators as well as speculation that the ECB would surprise on the hawkish side after all tomorrow.

The current option market pricing of 20% overnight vol in EURUSD for the October meeting (refer above table) implies a 0.84% daily spot breakeven on the day, which is closer to the upper-end of our estimated range of EURUSD spot moves between 0.5% -1.0% depending on the tapering package that the Bank announces.

Please be noted that the risk reversals of EURUSD signify the hedgers’ interest for the upside risks.

The degree of asymmetry in expected spot moves vis-à-vis current vol pricing is not enough in our view to motivate owning event risk premium over Thursday.

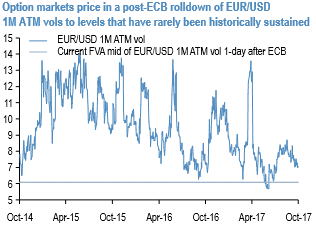

One aspect of short-dated EUR/USD vol surface pricing that does strike us as anomalous is the cheapness of forward volatility priced for after the ECB meeting. The above table shows that the event vacuum after the October ECB is reflected in a1 vol+ rolldown of 1M ATM vols post meeting. The absolute level of the forward vol matters too: 6.1 as the forward level of EURUSD 1M ATM vol after the meeting date at the time of writing is extremely low and has rarely been reached let alone sustained judging by the history of EURUSD 1M vol in recent years (refer above chart).

Additionally, Euro spot has been realizing 6.0 -6.5% in recent weeks even in a quiet market, so there is no risk premium priced into forward vols for any unexpected dollar volatility brought about by either a re-pricing of Fed expectations or more trade/NAFTA/fiscal noises out of Washington.

Owning post-ECB forward vol is therefore much better risk-reward in our view than buying the event itself.

Well, contemplating all the above fundamental factors, on hedging grounds, we uphold longs in a 2m 1.1750 (ATM) - 1.23 EURUSD call spread that was initiated on September 29th. Marked at 42.3bp.

Currency Strength Index: FxWirePro's hourly EUR spot index is gaining traction ahead of this week’s ECB meeting, displays shy above 68 levels (bullish), while hourly USD spot index was inching higher towards 54 (bullish) at the time of articulating (at 06:58 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

Hence, bulls may resume any time upon these indications.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts