We have further raised our EUR-USD forecast, as we believe that the depreciation trend of the US dollar is not yet over. It is becoming increasingly apparent that the Fed will stick to an ultra-expansionary monetary policy for much longer than was the case after past crises by which it is more and more resembling the ECB.

The euro does not really have that much to offer these days either. The major economic publications are behind us and have been priced in, the markets are in a holiday mood anyway and there is no new impetus from monetary policy. The bottom line is that with 1.19 we probably have seen the highs in EUR-USD for the time being, but at the same time there are no good reasons for levels below 1.16.

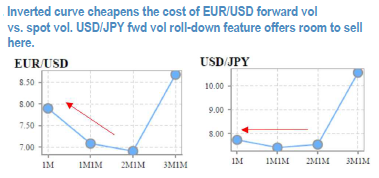

The latest enthusiasm about a faster European economic post-COVID-19 recovery driving a 1m +6% rally in EURUSD have also triggered some significant activity on the Gamma segment of the curve, with 1m ATM vol rallying by about 1.5 vols between 20th and 27th July. Current shape of the vol curve is modestly inverted up to 1y which naturally paves the way for buying forward volatility at a discount. 1st chart shows EURUSD 1m vol in 2m time

to be 1 vol cheaper than outright spot vol. That contrasts USDJPY with nearly no short-dated inversion. Also, EUR vol has more room to reprice higher than JPY vol on the back of a higher estimated volatility for the rates differential (refer 2nd chart, find more details on the

analysis applied to 1y ATM vols). Amid little clarity around realized vol prospects during the August liquidity crunch, fwd vol seem like the right type of structures to mitigate the risk that softer realized vols would impose on outright gamma.

Spread structures, such as EURUSD - USDJPY 1M in 2M FVA spread, provide a further edge with its offsetting and thus low net decay characteristics that helped the fwd vol spread hold well over last couple of years. The spread structure should insulate and even benefit from potential downside pressure on preelection vols. With all eyes on EUR and expectations for muted yen spot action we think it worth to consider:- Long 1M in 2M (Sep 30 – Oct 30) EURUSD FVA @7.125/7.525indic vs short USDJPY FVA @7.3/7.7indicative. Courtesy: JPM

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data