Today’s US Federal Reserve policy announcement is expected to be considerably less ‘exciting’ than the Bank of England tomorrow. Having reduced interest rates three times last year, Fed officials believe the economy is now in “a good place” (we get the first estimate of US Q4 GDP tomorrow).

Hence, the Fed is widely expected to keep interest rates on hold at the 1.5-1.75% target range. There are no new forecasts at this meeting, so markets will be looking at the statement (which is expected to be broadly little changed from December) and the tone of Chairman Powell’s press conference.

The dollar has been the outperformer and illustrates in an impressive manner who is the ultimate safe haven in the FX universe - regardless of whether that is justified or not. The overall risk bias is positive reflecting EUR’s strong structural fundamentals and US political risk.

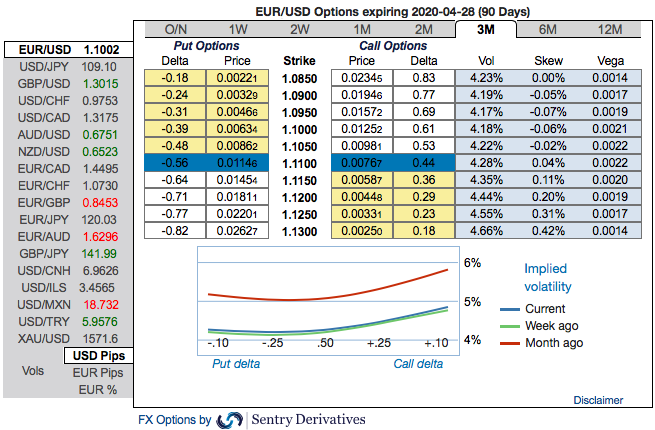

Most importantly, the positively skewed EURUSD IVs of 3m tenors are stretched on either sides but with slight biasness towards downside hedging risks (refer above nutshell).

Technically, there seems to be more room for EURUSD downtrend that is traveling through sloping channel, while both leading & lagging indicators are in sync with price slumps.

Hence, considering all these factors, the below options strategies are advocated, we now wish to uphold the same strategies.

Hedging Strategies: Contemplating above factors, initiated long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write an (1%) out of the money put option of 2w tenors, (spot reference: 1.1063 level). Short-legs go worthless as the underlying spot price hasn’t gone anywhere. Any slumps from here onwards are to be arrested by the 2 lots of ATM long-legs.

Those who are sceptic about mild rallies, 3m 1% in the money puts with attractive delta are advised on a hedging ground. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.

Those who want to participate in the prevailing rallies in the short run, one can freshly initiate the strategy. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately. Courtesy: Lloyds

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025