We already called for EURUSD downside one month ago at 1.10 (And now the euro is almost at 1.0625 levels), recommending bearish structures via options portfolios.

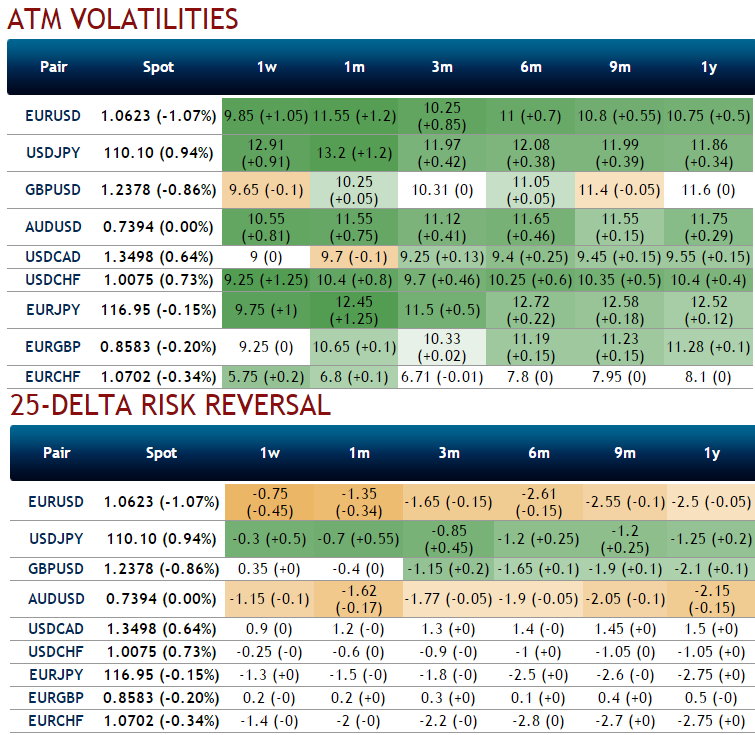

Please be noted that from the IV nutshell of ATM contracts of 6m tenors, the implied volatilities of ATM contracts of this the pair are flashing at around 9.85% for 1w expiries and hovering above 11% across longer tenors. We reckon that EURUSD 6m implied volatility has been fairly bid, rising above 11.

Our central scenario sees only moderate near term EURUSD weakness, but the current balance of market risks suggests considering more aggressive hedges via options, bearing in mind a case for medium-term depreciation below parity. The 6m expiry is appropriate, as it captures Italian referendum, general elections in German and the second round of the French presidential election on 7 May 2017.

Option Strategies:

A 2m digital put strike 1.0750 KO 1.0450, This cheap option (costing 11% at that time) is now in the money and will expire right after the December Fed meeting (already priced). Though a scenario of further euro downside would be gradual, the risk of hitting the barrier is much higher post-Trump’s election.

Reverse Put Spreads: We see option writers would be on the competitive advantage as you could probably make out from the nutshell showing implied volatilities of ATM contracts of 1w expiries are reluctant to rise comparing to the longer tenors (for example IVs shrinking below 9.85% for 1w tenor and rising over 11% in 1m-1y tenors). Hence, 2w/2m reverse put spreads with strikes 1.0666/1.0890 in 2:1 ratios, the option structures resembling these types with longer tenors are also encouraged.

Buying digital puts for aggressive bears: This trade is a vanilla 6m European digital put with a strike at 0.97. This option likely to deliver its notional amount if EURUSD trades below this level at the expiry, a pay-off of nearly eight times the premium amount. It can be replicated by a very tight put spread and is, therefore, taking advantage of the high skew.

Buy downside seagull : This variant of the digital put also provides constant leverage below 0.97 but is a zero-cost strategy. The structure fully finances a 6m put spread 0.99/0.97 via a deeply OTM call with a strike at 1.17 (unlimited risk above that level). Since EURUSD entered into consolidation mode in March 2015, its highest level was 1.1717 (August 2015).

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential