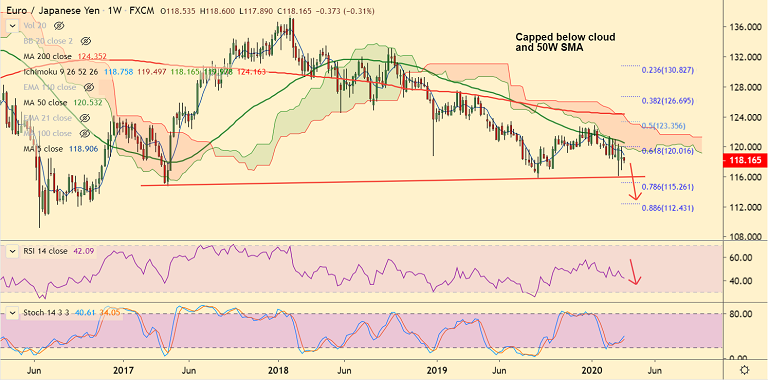

EUR/JPY chart - Trading View

EUR/JPY was trading 0.36% lower on the day at 118.16 at around 05:40 GMT, after closing 0.17% higher in the previous session.

Fears of a coronavirus-led slowdown in the global economy were bolstered after the US Senate's failure to push forward the rescue package.

The pair has failed to break past 21W EMA and weekly cloud and 5W SMA has turned sharply lower.

GMMA indicator shows major and minor trend on the weekly charts is strongly bearish.

Indicators on the daily charts have turned neutral, but the pair has completed a 'Death Cross' on the daily charts which could plummet prices.

Lower Bollinger band at 116.86 is immediate support ahead of major trendline support at 116. Break below eyes 78.6% Fib at 115.26.

On the flipside 21-EMA is immediate resistance at 118.84. Break above 50W SMA (120.53) could support near-term upside.

Support levels - 116.86 (Lower BB), 116 (Trendline)

Resistance levels - 118.84 (21-EMA), 120.53 (50W SMA)

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts