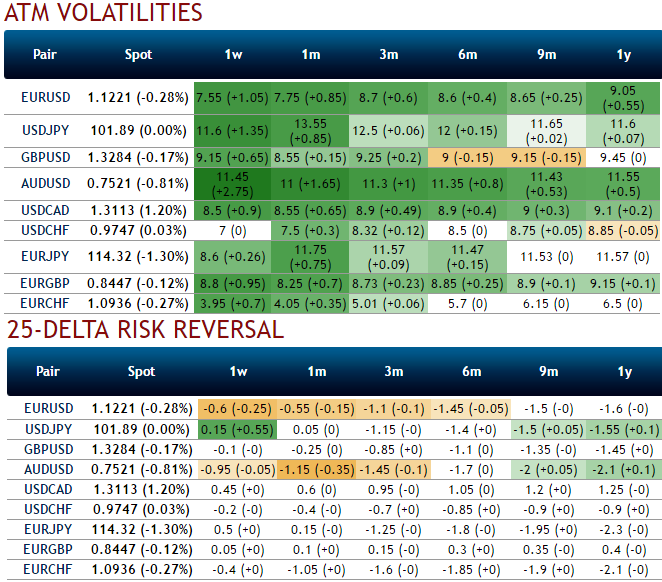

As the delta risk reversals of EURJPY have again shown in bullish interests as the progressive increase in positive numbers to signify the traction for short term upside sentiments in 1w expiries but no changes for further downside risks in long-term tenors.

From these risk reversal numbers, the hedging framework can individually be tailored, structured to meet your needs. You can define:

The risk reversal allows for a customized hedging solution, tailored to your risk and hedging profile. risk reversals are OTC derivative instruments and the notional amount does not need to be tied up throughout the full tenor of the trade.

Consequently, the pair has been gaining bullish momentum ever since the formation of morning star pattern, showing upswings from the lows of 113.934 levels to the current 114.501 levels but long term declining trend seems to be intact as you can see the convincing volumes and technical indicators favouring bears on the monthly charts.

While IVs of ATM contracts of 1w and 3m tenors are spiking considerably at shy above 8.6% and a tad below 11.6% respectively, this has been justified by historical volatilities in spot FX fluctuations (see big real body candles on monthly technical charts).

Well, any abrupt upswings should not be panicky, instead deploy them in the below option strategy.

Using these deceptive rallies, you decide to initiate a bull put spread at net credits that is likely to fetch certain yields, short 1W (-1%) in the money put with positive theta if you expect that EURJPY will spike up moderately over the next near future but certainly not beyond your imagination, simultaneously, buy next month at the money -0.49 delta put option.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data