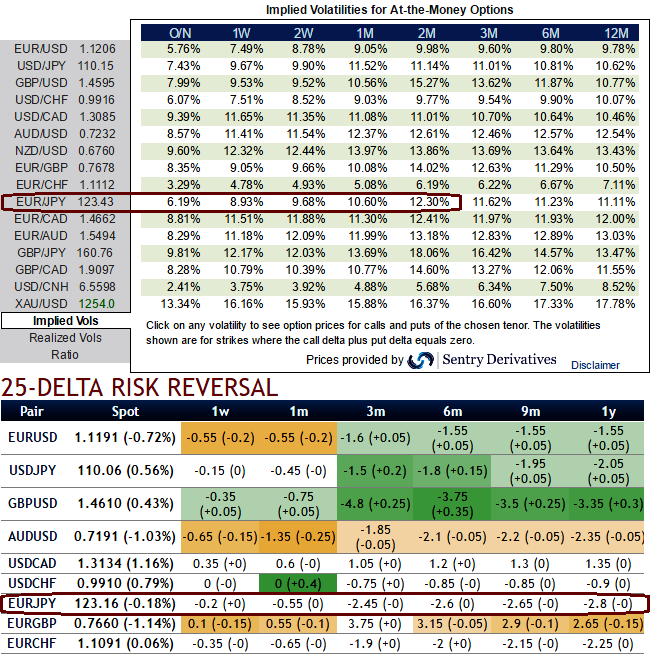

OTC Updates: The current implied volatility of ATM contracts is at 6.19% and little below 9% for 1w expiries but inching higher 12% for 2m tenors which means favourable atmosphere for option holders in OTC markets.

But as you can observe delta risk reversals are indicative of participants in this pair are more concerned about further slumps especially from next 3 months timeframe.

Rising negative flashes indicates active hedging sentiments for these downside risks but these risk reversals have neutral to slightly showing a sense of recoveries.

Well, that is where a shrewd option is likely to target, shrinking IVs with neutral to minor positive numbers renders the opportunities for short term option writers (compare 1w IVs at 6.19 with 1w delta RR).

25-delta risk reversal reveals the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market, subsequently, the put are the expensive comparatively to the calls.

Acknowledging the gradual increase in the implied volatility of EURJPY but with higher negative risk reversals in long run is justifiable when you have to anticipate forwards rates and observe the spot curve of this pair (see IVs, RR nutshell, Sensitivities, and compare with spot prices).

Technically, the recent rallies have now tested and rejected resistance at 21DMA & 124.445 levels (daily charts), that’s where a “Shooting Star” pattern occurs, as a result, we see bears resuming again, the major downtrend has been slipping through falling wedge formation on monthly charts, current prices testing supports at baseline of falling wedge, the current prices remain well below EMAs despite attempts of bounces.

Major trend is declining trend, from last two years or so the pair has consistently evidenced price slumps more than 17%, and we could still foresee more downside potential ahead.

Hedging Positioning:

Pondering over above reasoning, one can still eye on loading up with fresh longs for long term hedging for downside risks, load up weights in longs comprising ATM instruments and ITM shorts in short term would optimize the strategy.

Hence, “Short 1W (1%) ITM put option, go long in 2 lots of 1M ATM +0.49 delta put options, thereby net delta should remain at around -0.66 and the strategy would be in theta advantage on both short and long side as we've chosen narrowed strikes as well expiries.”

We used narrowed expiries so as to suit the OTC market trends and to reduce the hedging cost. The quantum in above mentioned strategy is just for demonstration purpose only, one can load up weights according to the FX exposure in their portfolio.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays