After BoJ stands pats to continue the negative rates at -0.1%, EUR/JPY also continued its bearish trend again.

The BoJ changed the tone from its statement that it would cut interest rates further into negative territory if needed, and said it would exempt money reserve funds from the negative rates policy.

Given concerns on limits of the policy arsenal at the BoJ and rising euro-centric risks, we recommend initiating short EURJPY positions for long term hedging.

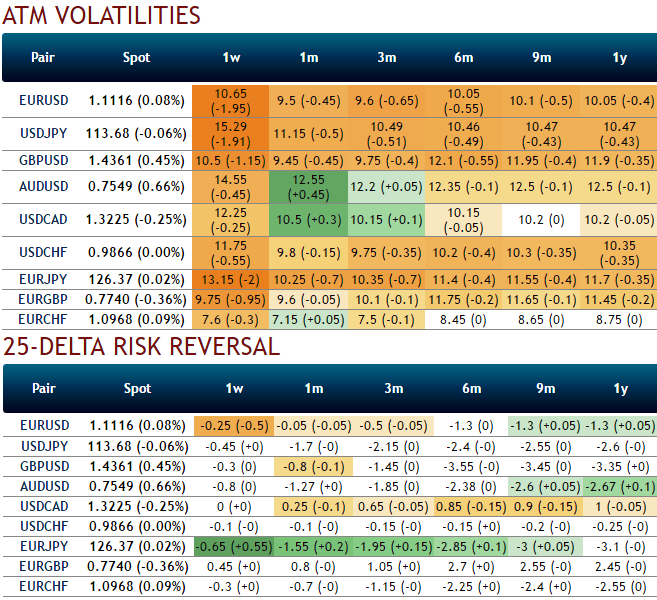

As the delta risk reversals have again shown in bearish interests as the progressive increase in negative numbers signify the traction for hedging sentiments for downside risks in both short and long term.

While current IVs of ATM contracts are at higher levels but have shrunk away after central bank policy events in both euro zone and Japan, it is likely to perceive at an average of 12% in long run would divulge pair’s gain (see 1W-1Y ATM IVs).

Capitalizing on interim upswings in EURJPY, shorts have been favoured by acknowledging the implied volatility fading away in of Euro crosses (see nutshell).

Technically, our bearish view in long-term for EURJPY was again encouraged by not sustaining at 127.465. Lack of upside traction following the January uptick points to further weakness in the coming weeks. The break out of supports at 126 often and often, we can understand the intensity of prevailing bearish trend as we recently saw a breach of channel support as well.

Contemplating above current technical reasoning, risk reversal positioning and the implied volatility of ATM contracts for near month expiries of this the pair is at around 10.25%, we eye on loading up with fresh longs for long term hedging, more number of longs comprising both ATM and OTM instruments ITM shorts in short term would optimise the strategy.

Since, we think more downside risks are still on the cards in long run, as result, deploying as many ATM delta instruments as possible would serve the ideal hedging objectives (as per risk reversal indication), this would be used to measure the value of an option as the market moves. This is useful to monitor directional risk so you may know how much your option’s value will increase or diminish as the underlying spot FX market moves.

FxWirePro: EUR/JPY risk reversal favours bears, writers capitalize on IVs - Bid RR and load up weights in longs to hedge

Tuesday, March 15, 2016 6:35 AM UTC

Editor's Picks

- Market Data

Most Popular