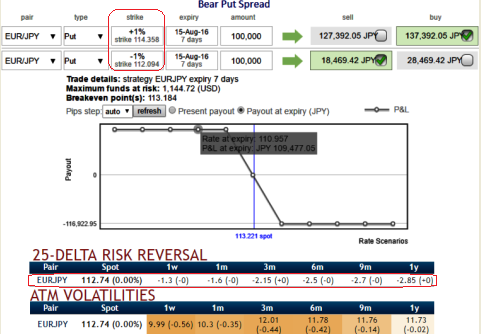

As the delta risk reversals have again shown in bearish interests as the progressive increase in negative numbers signify the traction for hedging sentiments for further downside risks in both short and long term.

Amid the apprehensions on perimeters of the policy arsenal at the BoJ and rising euro-centric risks, we recommend initiating short EURJPY positions for long-term hedging but by capitalizing on every short-term upswing, preferably via options during upcoming ECB meetings.

Until there is real domestically-generated inflation, it is hard to call EUR sustainably higher. Eventually, we think EUR recovers but it will be in a snail’s pace.

Well, in order to benefit from a favourable market move up to the higher strike:

As shown in the diagram for pay-off function of a debit put spread of EURJPY, below factors are indicative as to how it works at expiry, one of the following scenarios may occur:

1) Underlying trades below the lower strike then you sell the notional amount at the lower strike.

2) Underlying trades at or above the lower strike and below the higher strike, no transaction takes place on the settlement date. You could sell the notional amount at the prevailing spot rate (outside this structure).

3) Underlying trades at or above the higher strike, then you are obliged to sell the notional amount (multiplied by the leverage factor, if any) at the higher strike. Your profit potential is limited at the higher strike.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data