Glimpse at economic data announcement:The major data focus for the day, is that French and German PMIs prints in manufacturing and service sectors. The IHS Markit/BME Germany Manufacturing PMI came in at 56.9 in July 2018, slightly below a preliminary reading of 57.3 and compared with June's 18-month low of 55.9. Output growth and business optimism both accelerated to a three-month high and new orders advanced at a faster pace, with new business from abroad rising the most since April.

Elsewhere, the France manufacturing PMI surged to 53.3 in July of 2018 from 52.5 in June, above an initial estimate of 53.1 and beating market expectations, final figure showed. Well, the output and new orders growth increased at a faster pace. Also, purchasing activity rose and job creation advanced at its strongest pace in six months. In contrast, new export orders fell for the first time since September of 2016, amid lower foreign demand due to global trade tensions. On the price front, input and output price inflation accelerated, due to higher cost of raw materials including steel, oil and wood. Looking ahead, optimism remained strong mostly linked to positive sales forecast in foreign and domestic markets.

OTC outlook:

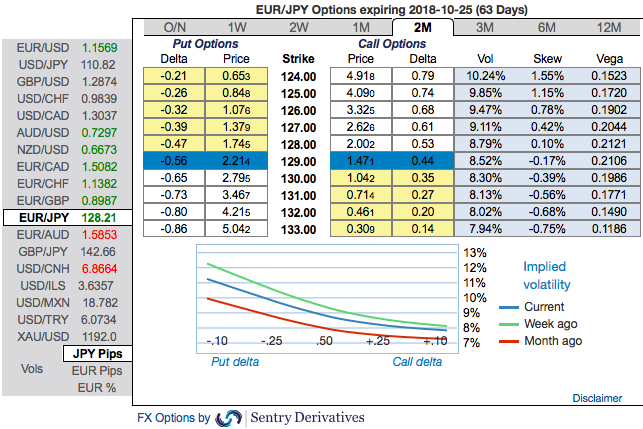

Most importantly, please be noted that the positively skewed IVs of 2m tenors are signifying (1.55) the hedging interests in the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 124 levels so that OTM instruments would expire in-the-money.

While negative risk reversal numbers of all euro crosses (especially EURJPY) across all tenors are also substantiating bearish risks remain intact in the long-run.

Technically, we already raised red flags about EURJPY bearish risks. For details, please follow the below weblink: https://www.econotimes.com/FxWirePro-EUR-JPY-flurry-of-bearish-patterns-move-in-sync-with-price-and-volumes-confirmation--Trade-tunnel-spreads-and-short-hedge-1419256

Options strategies for hedging:

Contemplating above fundamental driving forces and OTC indications, at spot reference: 128.21 levels, we’ve devised various options strategies:

Buy 2M EUR puts/JPY calls vs. sell 2M 28D EUR puts/KRW calls for directional traders.

Buy 2m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1.

Sell 4M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged for risk-averse traders. Courtesy: investing.com

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 97 levels (which is bullish), while hourly JPY spot index was at -118 (bearish) while articulating at (07:00 GMT). For more details on the index, please refer below weblink:

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty