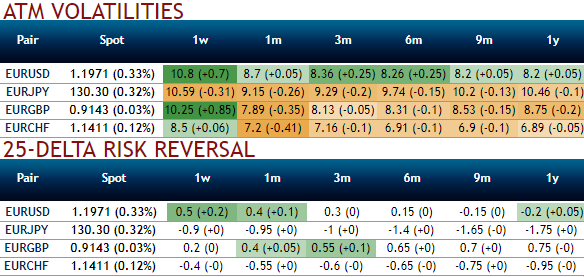

Please be noted that the implied vols of euro crosses have been shrinking lower in spite of the series of data flows are lined up.

German trade balance, French budget and industrial production numbers are due to be announced today.

EUR vols and bearish neutral risk reversals have been shrinking to the lower level. Also, in longer tails, the EUR volatility smile remains flat compared with the rates vs vol correlation seen since 2015 and over the past week.

The steepness of the EURJPY risk-reversal curve renders back-end tenors better shorts, risk reversals have been bearish neutral. While positively skewed IVs towards OTM put strikes signifies hedgers’ bearish sentiments but puzzles prevailing uptrend of euro.

However, we prefer sticking to 2017 expiries (6M) since 2018 dates come with unpredictable Italian election risk. The EUR/gold risk-reversal curve is much flatter in comparison hence short tenors work fine. We enter short 6M 25D EURJPY risk-reversals (delta-hedged).

We advocate maintaining the bullish exposure in EURJPY via a call RKO as JPY weakening is likely to be a slow grind rather than explosive.

Sell 6M EURJPY 25D IVs and risk-reversal (buy EUR calls - sell EUR puts), delta-hedged.

Vol pts Positive smile theta participation in Euro bull-trend.

The macro theme of euro area leading outperformance remains dominant; maintain core EUR or proxy longs as growth and inflation data continue to be supportive. Accordingly, encourage long EUR vs in cash (vs USD) and through options in EURJPY (130 call, RKO 134).

Any spot holdings, wise to book returns in long EURJPY cash; but stay long EURJPY in options structure.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics