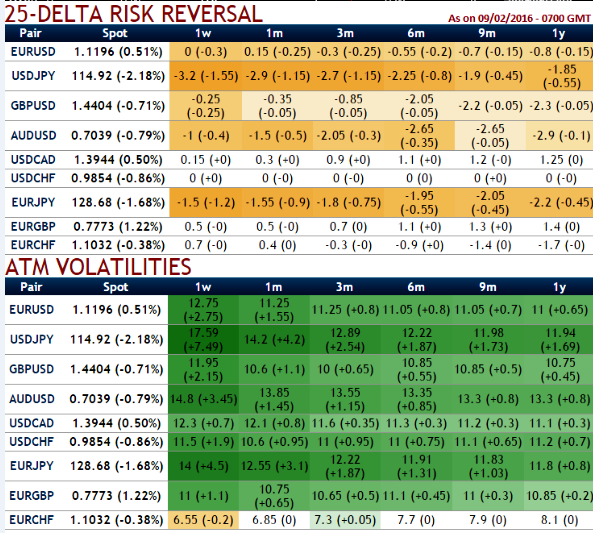

EUR/GBP forward volatility is cheaper (for next 3 months expiries) because EUR risk (shifting the entire curve higher) somewhat offsets future GBP risk (causing the steepness of both GBP curves).

However, EUR risk is more imminent than GBP risk and should be concentrated in the front end, consistent with the inverted EUR/USD curve (the EUR/USD 6M forward premium is negative).

Options are also discounting a large EUR risk on a forward basis (European fallout of a Brexit), reducing the EUR/GBP forward premium.

Buy EUR/GBP 1Y delta call strike at 0.80, Sell 1M call strike at 0.85 Indicative offer: 0.65% (spot ref: 0.7750)

Risks: Since risk reversals are pointing higher and favoring euro's gains, early EUR/GBP appreciation. The risk of the calendar call structure is limited to the premium paid up to seven months (expiry of the short option).

Beyond this date, investors could face unlimited topside risk if EUR/GBP trades above the 0.80 strike at the 7M intermediate expiry but below it at the 1Y final expiry.

In that event, the long option would be out of the money, realizing the loss supported four months earlier on the short option.

GBP/USD would fall more than EUR/GBP would rise in a Brexit scenario. However, this does not imply that the optimal hedging solution is expressed in cable. We have devised a directional forward hedge that takes advantage of the complacency in EUR/GBP forward volatility and skew.

The area of profitability in seven months is between 0.75 and 0.87, and if EUR/GBP is below 0.80 at end-June, investors would be left long a 5M call paid at a lower premium ahead of the referendum, with full topside and vega exposure.

FxWirePro: EUR/GBP and GBP/USD vols look cheaper than EUR/USD in Brexit scenario

Wednesday, February 10, 2016 12:17 PM UTC

Editor's Picks

- Market Data

Most Popular

2