The euro has scope to trade into a lower range below 1.12 if the European Central Bank (ECB) strikes a dovish tone at its governing council meeting on April 10. The ECB may, after its surprise TLTRO III announcement on March 7, follow through with a tiered deposit rate to help banks cope with the weak Eurozone economy. EURGBP has been oscillating between a tight range of 0.8994 – 0.8282 levels, but the major trend remains puzzling even though bearish bias in the minor trend.

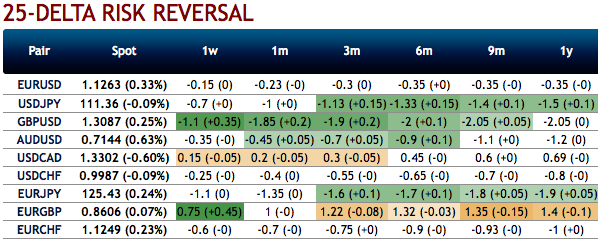

Well, let’s just quickly glance at OTC outlook before looking at the options strategies.

Fresh positive bids in the shorter tenors of EURGBP have been observed to the broader bullish risk reversal outlook in the FX OTC markets, this is interpreted as the hedgers are still keen on bullish risks, while the pair displays 10% of IVs which is the highest among G10 FX space.

While positively skewed IVs of EURGBP has also been stretched out on OTM Calls. This is conducive for options holders of OTM call options.

Hence, 3-way options straddle seems to be the most suitable strategy for EURGBP contemplating some OTC sentiments and geopolitical aspects.

Sterling has been able to appreciate significantly as the Geopolitical surface considering the UK Parliamentary developments from the last week’s “meaningful” vote will continue to dominate the domestic focus. Until that emerges the risk of a no-deal Brexit remains in place, leaving the risk of Sterling setbacks high.

It remains more expensive to hedge against strong GBP depreciation, which means that an orderly Brexit in whatever shape is still seen as being more likely. However, the risk of things going wrong is high and as a result, we regard any GBP appreciation with much skepticism.

You see any fresh positive bids in EURGBP risk reversals to the existing bullish setup, it should not be perceived as the bearish scenario changer. Instead, below options strategy could be deployed amid such topsy-turvy outlook.

Options strategy: Keeping above seesaw geopolitical and hedging sentiments under consideration, 3-way straddles versus ITM calls are advocated, the strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 1m tenors, simultaneously, short ITM puts of 1w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks. Courtesy: Sentrix and Saxo

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 78 levels (which is bullish), while hourly GBP spot index was at -176 (highly bearish) while articulating (at 12:37 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data