The swiss franc against counterparts has appreciated aftermath Brexit series, but EURCHF has been an exception and trading between in a 1.0715-1.0950 range from last 1 month or so.

Short term risk sentiment will continue to pose appreciation pressures.

SNB likely to remain active despite the real economy and inflation still under pressure from the appreciation of the CHF, the currency remains heavily overvalued. Fundamentals still points to a weaker CHF.

The negative interest rates are likely to keep Swiss investors to invest more abroad, once global market sentiment improves.

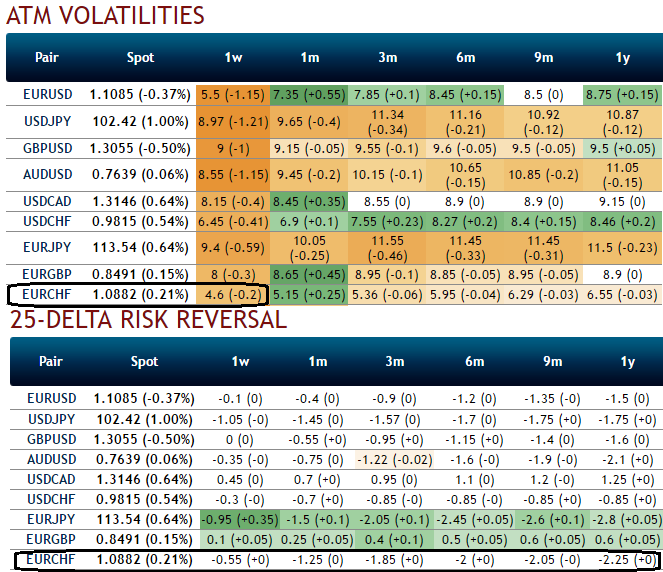

Please be informed that the implied volatilities of EURCHF ATM contracts of all expiries have been the least among G10 currency segment.

While, the 25-delta risk of reversal of EURCHF has also not been indicating any dramatic shoot up nor any slumps, but seems to be one of the pairs to be hedged for downside risks as it indicates puts have been relatively costlier. While the forecasts remain at 1.07 in 1 to 3 months.

To substantiate this view, underlying spot on weekly and monthly technical plotting, although the brief upswings but the trend has been pretty well in the range that has lasted almost for 1 year.

Here, the implied volatilities of ATM contracts are below 5% for next 1w tenors (4.6% to be precise) which is least among the G10 currency segment.

Hence, it would still be possible to keep aside the assured returns from this pair in the sideway trend, even though exhausted bulls who think long lasting non-stop streak of the bull run to take a halt at this point. Yes, that's quite achievable from iron butterfly strategy.

More readings on technical please go through the below weblink, thereby you can probably match the OTC functionality which is moving in sync with underlying spot FX:

Option Strategy (Iron butterfly spreads):

At Spot ref: 1.0898, iron butterfly strategy (EUR/CHF) can be executed as shown below.

To execute this strategy, the option trader assumes long on a lower strike Out-Of-The-Money put and shorts At-The-Money Put simultaneously short again on At-The-Money call and long on Out-Of-The-Money call, this results in a net credit to put on the trade.

Long 2w (1%) OTM -0.27 delta Put & Short ATM Put with positive theta + Short ATM Call with positive theta again & Long 2w (1%) OTM 0.27 delta call. Yields are certain as long as the underlying spot at expiration is equal to the strike price at which the call and put options are sold.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch