Sterling’s intraday drop, falling downbeat comments from lead EU negotiator Michel Barnier – who stated, “we are in deadlock” – highlights the sensitivity that the currency market displays to Brexit-related developments. The potential for a negotiation impasse was reinforced by sources attributed to UK officials (reported by Bloomberg) suggesting that the UK sees a “Brexit breakdown” if the EU refuses to compromise and progress to trade discussions.

Asymmetric uptick in G10 vols is more difficult to envision, since the mix of Fed repricing and tax reform optimism may draw a soft floor under the greenback for the time being even if this week’s upturn does not repeat, and coupled with the somewhat panicky unwinding of Euro (and other European FX) longs might leave macro investors less willing to spend option premium to play for EUR resurgence.

In this situation, if one had to pick one Euro bloc currency to buy vol in, our preferred pick would be GBP, especially on the crosses. We continue to believe that the abrupt shift in BoE policy and the attendant possibility of a policy mistake make sterling a fundamentally more uncertain currency than many others.

The range of spot outcomes on cable has now opened up from a previously narrow 1.28-1.30 band to a much wider 1.28 -1.36 (or higher) which ought to command a higher premium in implied vols than before. Yet GBP implied vols have retraced 3/4ths of the ramp up from earlier this month, and the realized vols are clocking recently at 1 vol above short dated implieds, hence this appears to be a case of underpriced fundamental uncertainty with supportive technicals for gamma ownership.

GBPCHF (GBP vs CHF implied correlation 40%, realized corrs 35%) in particular strikes as a useful long within the GBP-cross complex, we prefer financing it via shorts in EURCHF.

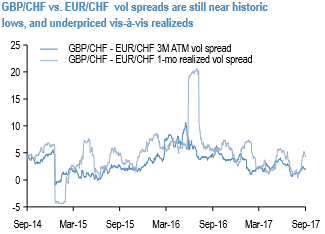

The GBPCHF – EURCHF vol spread has picked up from 15y lows but is still stuck near the bottom-end of a long-term range, the vol spread has a desirable tendency for one-sided eruptions in favor of a wider GBPCHF premium during market crashes, and enjoys a healthy positive carry at inception (2M ATM vol spread 1.9 mid, realized vol spread 4.0 on 1w and 4w look backs using hourly spot data; refer above chart).

From a tail risk standpoint, previous research shows that the RV is well-insulated to SNB shenanigans; we open a 2M ATM straddle spread this week. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is inching higher towards -119 levels (highly bearish), while hourly EUR spot index was at -97 (bearish) and CHF at 26 while (mildly bullish) articulating at 09:35 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic