Technical glimpse: After the break out below 1.4949 and the neckline of double top has more downside potential, currently at 1.4786 levels after rejecting resistance at 1.4827 levels.

From last couple of days, it has now been drifting in sideways by showing some selling momentum but on the contrary the bulls are holding stronger supports at around 1.4555 levels.

Option Strategy: 3-Way diagonal options straddle versus call

Spread ratio: (Long 1: Long 1: Short 1)

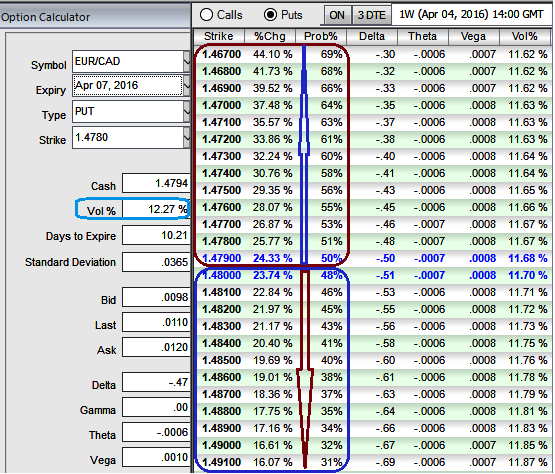

Rationale: Contemplating above mentioned technical environment, and ATM implied volatilities of 1W expiries are at 12.27% which is on higher side among G7 currency segment.

In addition to that, let's glance on OTM strikes, %change in premiums and %probabilities in hitting these strikes on expiration that keeps us eye on shorting expensive calls with shorter expiries in conjunction with ATM straddles.

As a result, we capitalize on such beneficial instruments during higher volatility times and deploy in our strategy.

How to execute:

Go long in EURCAD 2M at the money delta put, go long 1M at the money delta call and simultaneously, Short 1W (1%) out of the money call with positive theta.

Margin: Yes, required to short OTM calls.

Description: Trade the expectation of increased volatility without taking a view on direction but slightly bearish bias.

A strategy usually utilized over significant economic data events and other political events.

Profit: The profitability amplifies as the underlying spot FX of EURCAD rises but to the extent of OTM strike price or unlimited returns on slumps.

Loss: The maximum loss is the premium paid for the options.

Effect of Volatility: Directly proportionate to the volatility, the value of both options premiums would likely to enhance as volatility increases (good) and will decrease as volatility falls (bad).

Note: Extra bit of advantage comes through shorting on OTM call that finances the total cost of trade but be mindful of OTM strikes.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand