As occurred in the US before the Treasury taper tantrum in 2013, ECB QE has created a valuation and positioning problem that biases the euro to appreciate on even subtle changes in ECB policy.

Typically, QE programmes drive yields to unjustifiably low levels and encourage investors to accumulate long duration positions in bonds/short positions in FX on the belief that easy money policies will persist indefinitely.ECB taper talk is premature; minutes of September meeting show QE expansion still firmly on track.

The length of any QE expansion is uncertain, though, and there is a chance that the pace is reduced modestly.

IP data rebounded in August as holiday distortions unwound, but Q3’16 still looks quite soft, overall retail sales continue to trend higher and bank lending rates decline.

According to a report this week by Bloomberg, an “informal consensus” has built among ECB governors that net QE purchases will be tapered in steps of €10bn per month rather than ended abruptly.

The “sources” did not exclude an extension of the current program beyond March 2017 at €80bn per month, saying instead that any decision about when to actually start tapering will depend on the economic data and on whether scarcity issues can be addressed.

But the tone of the article was that tapering could be considered in March. We continue to expect the euro to tick higher into 2017 despite Fed tightening, crude’s strength and particularly given the ECB's misgivings about its QE programme.

Elsewhere, the crude oil price rally on the back of the surprise OPEC announcement of production cut plans was well timed offset to weak-CAD pressure from the focus on election risks and the repricing of a December Fed hike, even if the execution risk of actually delivering a concrete production cut ceiling is high. In the past two weeks, the 13% rally in WTI crude was worth 1.1% lower in USD/CAD on our short-term fair value model.

FX Option Trade Tips:

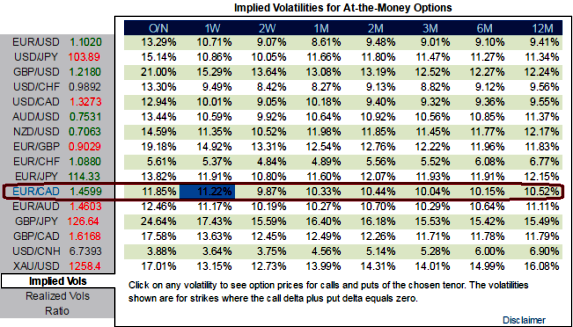

Hence, at spot ref: 1.4603 (while articulating) we advocate below FX derivatives strategy as we favor optionality to the directional trades. After a series of bearish streaks in this week we are inclined to position for a partial retracement of the down move through put spreads, as calling the bottom is difficult and adding directional spot exposure is risky at the moment.

Alternatively, using any abrupt rallies, you decide to initiate a diagonal debit/bear put spread (DDPS) at net debit 1w ATM IVs of EURCAD is just shy above 11.20%, and likely to spike higher 10% in 1-3m tenor.

The execution: Initiate shorts in 1W (1.5%) out the money put with positive theta, simultaneously, buy 1M in the money -0.5 delta put option. Establish this option strategy if you expect that EURCAD would either expect sideways or spike up abruptly over the next near future but certainly not beyond your upper strikes.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady