Let’s suppose that the USD is still pegged to gold, and the pegged dollar would have heavily restricted both the US Congress’ and Fed’s abilities to unleash fiscal and monetary support.

While there are benefits to the Gold Standard, this Covid-19 episode shows why the global monetary system is better off without it. The prevailing financial and liquidity crunch highlights inherent failings within the economic system, and does not suggest gold has lost its status as a safe haven.

Gold seems to have lost its safe-haven allure in the past two weeks. Prices have declined below $1500/oz at time of writing, despite closing in on the $1700/oz level just two weeks ago. Logically, this makes little sense and is highly counter-intuitive. With global markets firmly in risk-off territory, the Fed slashing 150bp off its benchmark interest rate and equity markets enduring volatile sell-offs, gold should have benefited.

As Covid-19 started to invoke fears of a dollar liquidity crunch, gold became a ripe candidate for a selloff. The need for dollars from both within and outside the finance sector arose. Heavily stressed sectors like airlines and hotels reportedly sought to draw down credit lines as they tried to maintain operations. The finance industry, whipped by volatility, margin calls and financing needs, also started to demand more dollars.

Gold thus became a prime target for a selloff. As gold was a highly liquid asset and was one of the few markets still posting year-to-date gains, investors reportedly sold off gold to raise cash.

OTC Updates:

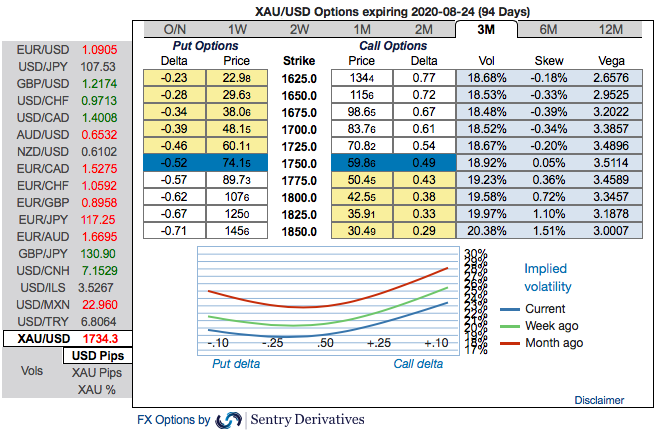

The 3m positive skewness of gold options contracts implies more demand for calls (refer 1st chart). These skewed IVs of 3m XAUUSD contracts are still indicating the upside risks, bids for OTM call strikes up to $1,850 is quite evident that reminds us hedgers’ inclination for the upside risks.

One could also see the fresh negative bids for the existing bullish risk reversal setup. To substantiate the above-mentioned bullish sentiment, risk reversal (RRs) numbers also indicate the overall bullish environment (2nd nutshell). Well, we know that options are predominantly meant for hedging a probable risk event in future.

Hedging Strategies:

Capitalizing on all the above fundamental drivers and OTC indications, we advocate longs in gold via ITM call options as they look to be the best suitable at this juncture.

Thus, we still advocate buying 3m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying.

Alternatively, on hedging grounds, we advocated long positions CME gold contracts of June’2020 deliveries as we could foresee more upside risks. Courtesy: Sentry, OCBC and Saxobank

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields