The RBNZ was very dovish at the May MPS. Despite inflation recovering in 1Q to above 2%oya for the first time in six years, Governor Wheeler stuck to his neutral guidance, and the staff maintained their forecast that the OCR would not rise until 3Q19. This has badly wrong-footed a rate market that pricing a significant chance of a hike by year-end.

The Governor describes the recent upside in inflation as tradable - driven and “temporary”, and at a more existential level, sees broader “inflation risk” as low, given that wages have been so benign and expectations are well-anchored. NZD should, therefore, be at the mercy of a reappraisal of the outlook for real short rates, particularly relative to the USD in 2017.

We expect NZD to fall through this year, reaching USD0.63 at year-end. The support to growth from migration will fade, while the RBNZ are showing commitment to holding rates steady, even as inflation has normalized, pushing real rates materially lower.

The economy is also now subject to credit tightening through numerous channels: macro-prudential constraints, regulatory initiatives, widening mortgage rate spreads, and banks’ discretionary tightening of credit criteria to businesses. While we expect the RBNZ to be on hold, there is a clear downside risk to the OCR if the correction in housing is sharper than expected.

Growth has weakened lately. GDP growth was 0.4% QoQ in the three months to December, a weaker than expected outcome. 3Q GDP was also revised down too, leaving “output growth in 2H16 weaker than had been expected” by the RBNZ, as noted in the May Monetary Policy Statement.

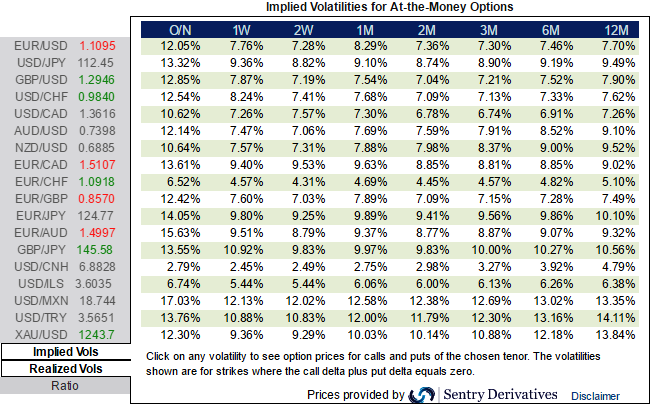

Please be noted that the ATM IVs of the pair has been quite below 7.9% and a tad below 8.4% for 1 and 3m tenors respectively. Skews have been still indicating the hedgers’ interests in downside risks.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated