UK Q2 GDP growth having been side-lined for a few days, some intra-day volatility was injected back into GBP after an FT report suggested that PM Johnson is likely to hold a general election in the “days after” Brexit (currently scheduled for 31st October). Implied volatility in GBP pairs have only moved marginally higher but was already trading at their most elevated since January.

With the release of Q2 GDP this morning, attention remained UK-centric. Following strong growth in Q1 (+0.5%q/q), the monthly GDP outturns have been somewhat softer, Q2 GDP prints 0.0%, dip from the previous duration’s 0.2%.

While the Brexit-related factors, some of which may be temporary, might have played their part. Stockpiling is one such example. Ahead of the March deadline, surveys suggested firms increased their holdings of stock in order to mitigate the possible effects from a disorderly exit. Overall, a flat reading (0.0%q/q), in line with the BoE’s latest forecast.

Well, in that perspective, before proceeding further let’s just quickly glance at OTC outlook and suitable strategy for GBPJPY swings.

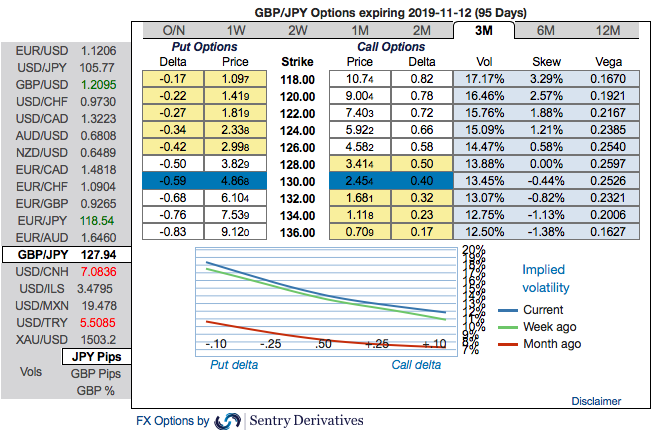

OTC outlook and Hedging Strategy: Please be noted that IVs of this pair that display the highest number among entire G7 FX universe.

While the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 118 levels (refer above nutshells evidencing IV skews). Hence, it is wise to capitalize on momentary upswings of GBPJPY and deploy OTM put writing.

Accordingly, put ratio back spreads (PRBS)are advocated on the hedging grounds. Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on current abrupt and momentary price rallies and bidding theta shorts in short run, on the flip side, 3m skews to optimally utilize delta longs.

The execution: Capitalizing on any minor upswings , we advocate shorting 2m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options (spot reference: 128 levels).

The rationale for PRBS: The position is a spread with limited loss potential, but varying profit potential. The degree of profit relies on the strength and rapidity of price movement. The position uses long and short puts in a ratio, such as 2:1 or 3:2, to maximize returns as explained above. In most long/short spreads, you make money if the spot fx moves, but you lose if it remains in the middle “loss zone.”

Every underlying move towards the ITM territory increases the Vega, Gamma, and Delta which boosts premium. As you could observe spot GBPJPY keeps dipping, these delta longs would become in the money, while these derivatives instruments target further bearishness of this pair. Courtesy: Sentrix & Lloyds

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close