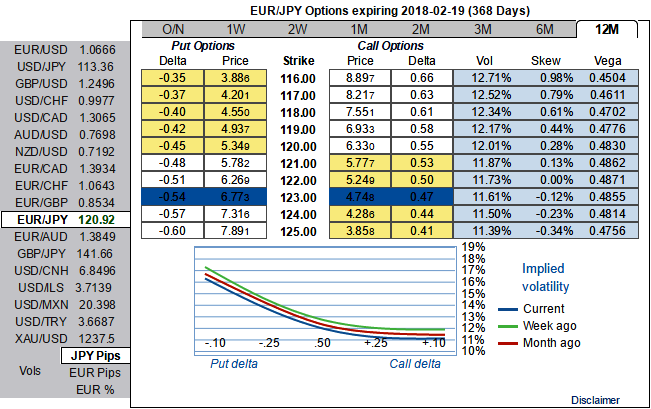

The EURJPY volatility surface is currently offering very attractive opportunities, as ATM volatility is rich and 6m/1y skews are excessively priced. Here, we recommend a couple of trades taking advantage of both the volatility and skew premiums.

In the volatility space, going short a 6m variance swap provides extremely high-profit odds. EURJPY 6m realized volatility has spent 78% and 89% of the time below the current variance swap bid level since 2007 and 2011 respectively.

We keep our EURJPY bullish bias as a directional reflation trade, which can be advantageously expressed via a zero-cost 3m topside seagull strikes 123.1715/121.1217/125.

Volatility trade: go short EURJPY 6m variance swap @14.3 (EUR indicative bid).

Trade risks: 6m realized volatility below 14.3 in 6m. Investors receive or pay the squared difference between the 14.3 strike and the terminal realized volatility and face unlimited losses if realized volatility is beyond this strike level.

Directional trades: Buy EURJPY 3m topside seagull strikes 123.1715/121.1217/125 Zero cost (indicative offer, spot ref: 120.9220).

Trade risks: unlimited below 123.1715. The structure is buying a standard call spread strikes 121.1217/125 fully financed by selling a put strike 123.1715. As such, investors face unlimited downside risk at the expiry if EURJPY trades below 123.1715.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges