Over 2018, we see scope for some further under- performance from NZD, as we expect ongoing confirmation that the RBNZ can credibly lag policy normalization in the G3. Evidence that real assets (equities, housing) are threatened by late cycle growth dynamics and government intervention would add further weight to this story.

Markets are now pricing a small chance of an RBNZ easing by early next year. At the June decision RBNZ Governor Orr maintained an evenly balanced outlook for the near-term, with addition of downside risks. The Governor stated the next rate move is equally likely to be up or down, and has placed significant weight on the fact that inflation expectations have become more backward-looking, which slows the recovery from several years of below target outcomes.

Bearish NZDJPY scenarios:

1) The NZ housing market slowdown becomes disorderly

2) The NZ immigration rolls over quickly

3) NZ bank funding issues intensify, causing the market to question NZ's ability to attract capital inflow.

Bullish NZDJPY scenarios:

1) Fiscal easing is delivered quickly

2) New RBNZ Governor Orr starts with a surprisingly hawkish bent.

NZDJPY’s trend has been within the tight range of 76.859 – 74.040 levels, but the pair is having more bearish traction and expected to depreciate upto 72.5 levels by 3Q’19 as RBNZ outlook remains on hold throughout 2018.

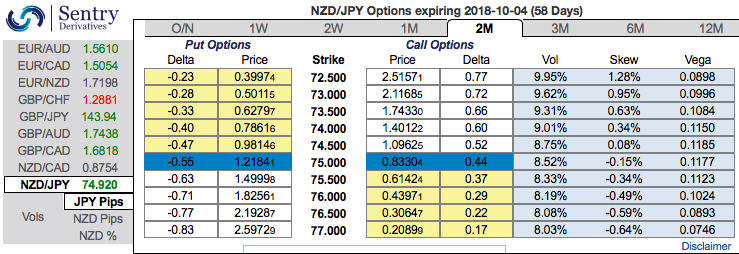

To substantiate this bearish stance, the 2m positively skewed implied volatility indicates the hedging sentiments for the lingering bearish risks. Bids are for OTM puts upto 72.5levels. As a result, we construct suitable options strategy favoring slightly on bearish side. Initiate 2 lots of 2m longs in -0.49 delta put options, simultaneously, add 1 lot of 0.51 delta call options of the similar expiry, the strategy is executed at net debit.

Contemplating both bearish and bullish trends of this underlying pair, to participate in the puzzling swings, we advocate option strips strategy that contains 3 legs of vega longs (2 puts plus 1 call) of 1m expiries. The option strips that likely to fetch desired yields regardless of the trend but more potential on southwards by arresting bearish risks.

One can deploy this strategy both on trading as well as hedging grounds. Please be noted that the strategy is likely to derive positive cashflows regardless of the underlying spot FX moves with more potential on the downside.

Currency Strength Index: FxWirePro's hourly NZD spot index is flashing at -112 levels (which is bearish), while hourly JPY spot index was at shy above 145 (bullish) while articulating (at 13:08 GMT). For more details on the index, please refer below weblink:

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.