How much further will the Brazilian central bank (BCB) cut its key rate? Today it will certainly cut it by a further 50bp to then 5%. It had signalled its willingness to do so at its last meeting in September, and the conditions for further easing are given. In September inflation stood at 2.9%, i.e. at the lower end of the BCB’s target corridor (2.75 - 5.75%). Moreover following a long-winded process the much feted pensions reform was finally passed by the Senate as well last week. As a result a major factor for uncertainty, which the BCB had also constantly referred to, has been overcome and as a consequence BRL was able to appreciate over the past days.

In addition, with the major domestic political risk out of the way after the passage of the social security reform in Brazil, and the global environment expected to be relatively benign over the next few weeks, there is room for BRL vols to catch-down to the softening in the rest of the EM vol complex over the past two weeks.

We do not expect BRL to be disrupted either by proxy hedging demand in the run-up to the upcoming Argentina election, or by the postponement of the December oil auction. 1M ATM vol (12.8) is already 1 pt. lower from its local high, and we reckon that realized vol can soften to below 10% with the SSR out of the way.

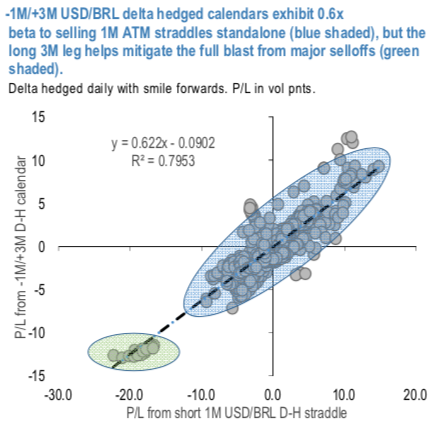

Given the flatness of the front-end of the vol curve (3M – 1M spread 0.2), we consider it prudent to quasi-hedge the outright gamma short by structuring it as a -1M / +3M straddle calendar (vega-neutral, delta-hedged).

The above chart shows that such calendar spreads capture 0.6x of the returns of standalone short 1M delta-hedged straddles on average, but the long 3M leg helps partially shield the structure from full impact of major vol shocks. Alternatively for maintenance free exposure consider 1M USDBRL vol swap @12ch vs. 1M1M FVA @12.55/13.1 indic spread, in equal vega.

Sell 1M @12.4 ch vs. buy 3M USDBRL delta-hedged straddles @12.5/12.85, vega-neutral, as a quasi-hedged outright gamma short. Courtesy: JPM

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal