AUD remained in ranging mode, mostly between 0.7747 and 0.7162:

Remains contained in a consolidative range of 0.7500-0.7600.

AUDUSD in medium term perspective: Lower to 0.7400. The US dollar’s impressive post-election rally may have paused, but still, has potential to rise further during the months ahead. As stated in our previous post on technicals, the major downtrend has been sliding through sloping channel but in the recent past it has gone into consolidation pattern (stuck in a range between 0.7747 levels on north & 0.7162 levels on south) but after testing support 0.7162 levels the prevailing upswings may prolong up to channel resistance (refer monthly plotting).

The Fed’s assertive tightening bias plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar.

Moreover, against that coal and iron ore are likely to sustain a good portion of their dramatic rises, and economic data for Q4 and Q1 should improve, but these forces are subservient to the US dollar’s trend. Australia’s AAA rating will remain an issue into the May budget.

OTC updates & option strategy:

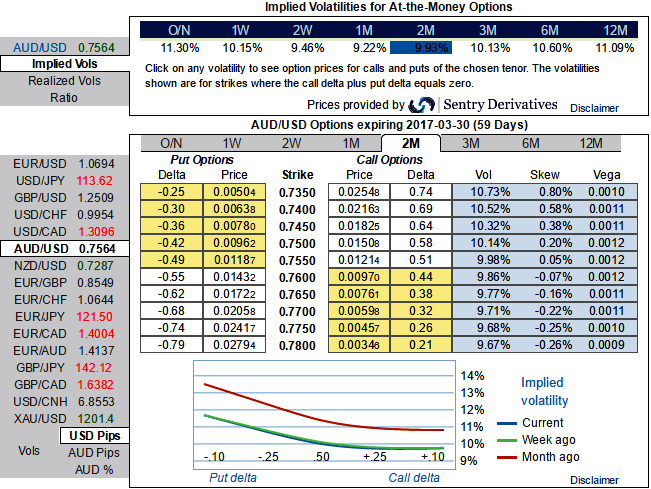

Initiate longs in 2m AUDUSD (0.5%) in the money -0.55 delta put; simultaneously, short 2m (2.5%) out of the money call (strikes at 0.7750) at net debit.

AUDUSD's higher IVs with negative delta risk reversal can be interpreted as an opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Rationale: Let’s glance on sensitivity tool for 2m IV skews would signify the interests of OTM put strikes that would imply that the ATM puts the higher likelihood of expiring in-the-money, so writing overpriced OTM calls would be a smart move to reduce hedging cost.

Fed Chair Yellen delivered hawkish comments on Wednesday, adding that the economy is approaching the Fed's dual mandate of inflation and employment. She further mentioned that the US is near full employment and with inflation figures stabilizing; there is a need for gradual Fed tightening, although she did not mention the exact timing of an interest rate hike.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons