Although Aussie dollar has been gaining from the last couple of days as the turbulence amid the U.S. election to weigh broadly on the greenback, the pair today is little changed against the dollar. As explained in our recent write up on technicals, the upswings are restrained at channel resistance and minor resistance at 0.7698 levels. From last three months, the price at this juncture has been held restrained and struggling to break out above this level.

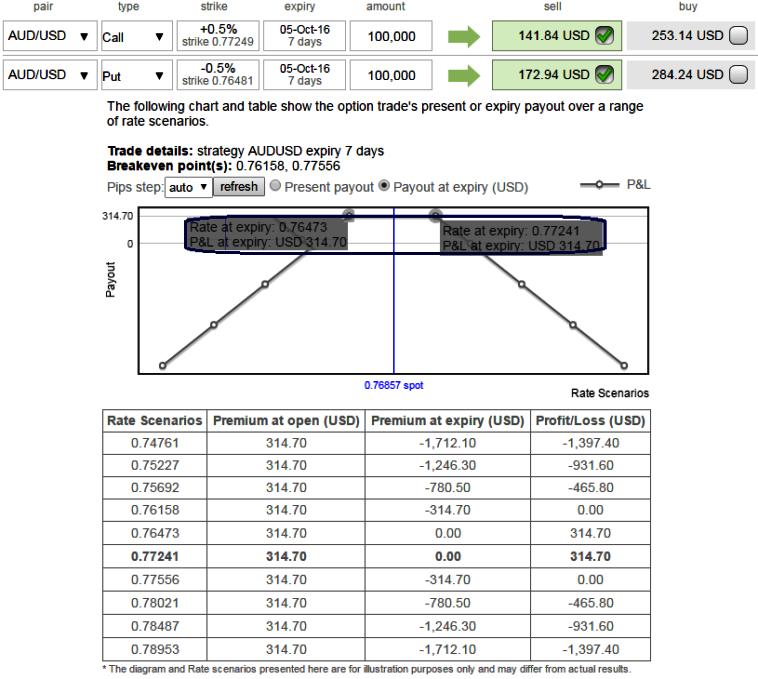

As a result, let's suppose that we execute following option trading positions by shorting 1w (1%) OTM put for and short (1%) OTM call of the same expiry.

While going long in spot FX of AUDUSD of same outrights, the cost of going long in the spot would be almost equivalent to that of premiums received from writing options from two legs.

Most likely scenario: On expiration, if AUDUSD rallies above the strike price of 1% OTM call strikes, the 1w put what short would go worthless.

While the shorts on ATM call expires in the money and the total outrights should be settled or obligated, but remember you are holding spot positions, thereby, you could discharge the obligation.

Adverse scenario: Alternatively, if the spot price of the pair keeps dropping due to failure swings, short call expires worthless but the naked short put and spot long position suffer large losses.

The short put is now worth more than what has been received and needs to be bought back while the long spot position has lost.

Covered strangles is limited returns, unlimited risk options strategies similar to the writing of covered call. But including the total premiums received upon entering the option trade would render the certain profits, if the spot FX remains stagnant.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data