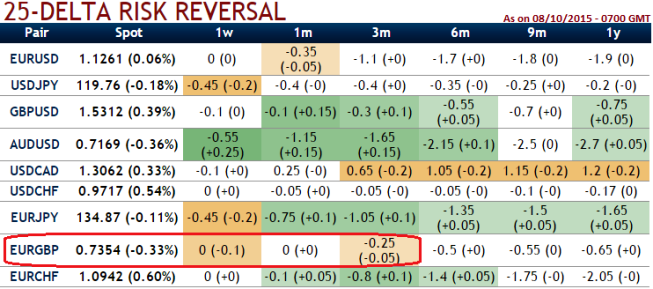

Well.., bulls gaining buying interest back again as 1W - 3M ATM contracts showing neutral flashes which is a positive note for EURGBP's strength, you can spot out this from the nutshell, but this is yet to be confirmed in long run even on technical charts. The same ATM contracts for next 6 months to 1 year expiries suggest prevailing long lasting downtrend still remains intact.

These risk reversal numbers compare the volatility paid/charged on out of the money calls versus out of the money puts. An aggressively out of the money (OTM) option is often seen as a speculative bet/hedge that the currency will move sharply in the direction of the strike price. The "Volatility Smile" chart below plots volatility-our proxy for demand-for OTM calls and puts.

Comparatively negative values indicate puts are more expensive than calls, in other words downside protection is relatively more expensive. Significant changes can indicate a change in market expectations for the future direction in the underlying FX spot rate.

Trade Tips: On a swing trading perspective, it is smart to buy at declines but for daily positional traders, short term dips are expected, we advocate buying binary delta calls on rallies for targets of 20-25 pips. Intraday charts buying interests caused by sharp bullish indications with long real body green candles and RSI curve is also moving in convergence with rising prices.