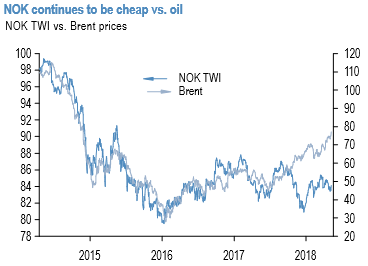

NOK valuations are still cheap with the currency still substantially lagging oil (refer 1st chart). The latest decoupling with oil has come amid deterioration in risk sentiment which we have been flagging as a risk for both Scandi currencies given that they have among the highest beta in G10 to equities.

US Treasury yields moved up modestly yesterday after new data provided further confirmation of buoyant US economic growth. However, the US dollar slipped against both the euro and sterling. Given today’s light data calendar markets are likely to look further ahead. This weekend’s G7 summit is coming into focus and markets will be looking for further indications on the state of global trade relations.

For active delta-hedgers, the current tightness of the USDNOK – EURUSD risk-reversal spread sets up good entry levels into a convex RV (refer 2nd chart) that has a solid track record of performing through the EU debt crisis years even when EURUSD was the epicenter of the crisis.

Ostensibly, the relative illiquidity/more frequent jumps in NOK contribute to higher delivered vols than in the more liquid EUR, which is why such spread trades are better installed in shorter, gamma heavy expiries than in longer ones. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -28 levels (mildly bearish), while hourly USD spot index was at 12 (neutral) while articulating at 07:04 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios