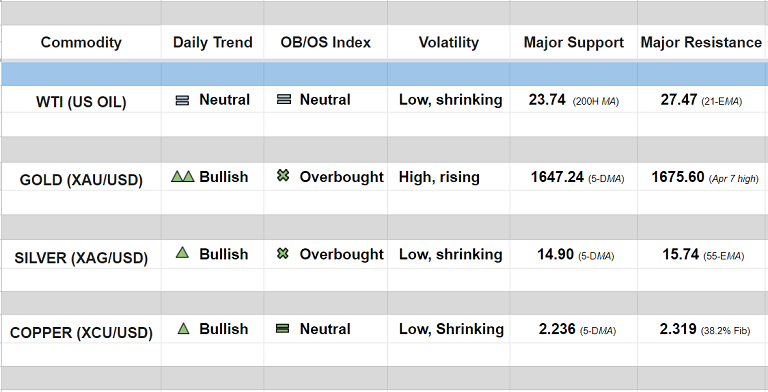

Daily Commodity Tracker (11:30 GMT)

WTI (US OIL):

Major trend - Strongly bearish; Minor trend - Neutral

Oscillators: Neutral (bias neutral)

Bollinger Bands: Volatility Shrinking on the daily charts, Rising on Weekly and Monthly charts

Intraday High/Low: 27.44/ 24.97

GOLD (XAU/USD):

Major trend - Slightly bullish; Minor trend - Bullish

Oscillators: At overbought

Bollinger Bands: Volatility Rising on Daily and Monthly charts

Intraday High/Low: 1654.342/ 1643.836

SILVER (XAG/USD):

Major trend - Neutral; Minor trend - Bullish

Oscillators: At overbought

Bollinger Bands: Volatility Shrinking on Daily charts, Rising on Weekly and Monthly charts

Intraday High/Low: 15.22/ 14.90

COPPER (XCU/USD):

Major trend - Strongly bearish; Minor trend - Bullish

Oscillators: Neutral (Approaching overbought)

Bollinger Bands: Volatility Shrinking on Daily charts, Rising on Weekly and Monthly charts

Intraday High/Low: 2.287/ 2.245

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms