Daily Commodity Tracker (12:30 GMT)

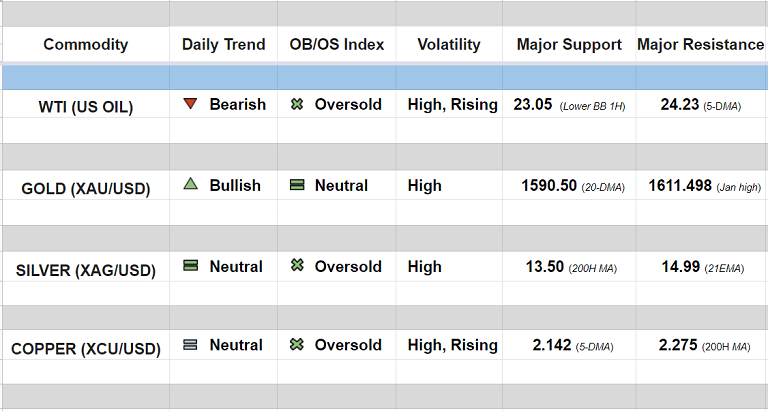

WTI (US OIL):

Major and minor trend - Strongly bearish

Oscillators: Oversold (no sign of reversal)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 25.14/ 23.74

GOLD (XAU/USD):

Major trend - Turning bullish; Minor trend - Bullish

Oscillators: Neutral (biased higher)

Bollinger Bands: Flat, volatility high

Intraday High/Low: 1611.371/ 1552.933

SILVER (XAG/USD):

Major trend - Bearish; Minor trend - Neutral

Oscillators: Oversold (On verge of rollover into neutral)

Bollinger Bands: Widening on Weekly and Monthly charts

Intraday High/Low: 14.2562/ 13.1748

COPPER (XCU/USD):

Major - Strongly bearish; Minor trend - Neutral

Oscillators: Oversold (On verge of rollover into neutral)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 2.186/ 2.082

FxWirePro: Daily Commodity Tracker - 24th March, 2020

Tuesday, March 24, 2020 12:39 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close