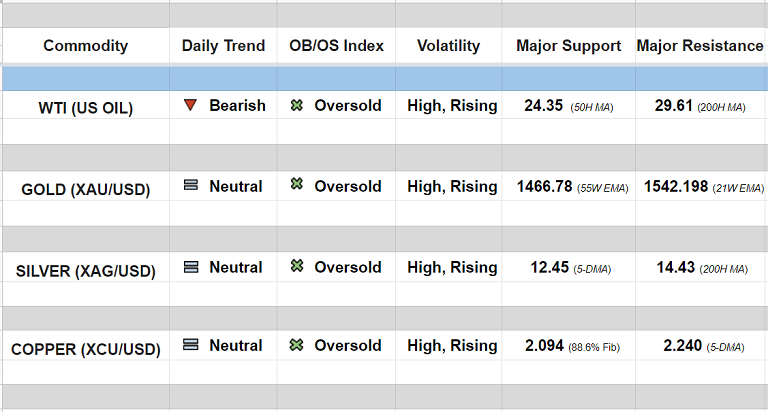

Daily Commodity Tracker (11:30 GMT)

WTI (US OIL):

Major - Strongly bearish; Minor trend - Turning neutral

Oscillators: Oversold (on verge of rollover into neutral)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 28.46/ 25.71

GOLD (XAU/USD):

Major trend - Neutral; Minor trend - Turning neutral

Oscillators: Oversold (on verge of rollover into neutral)

Bollinger Bands: Widening on Daily charts

Intraday High/Low: 1516.180/ 1455.320

SILVER (XAG/USD):

Major - Strongly bearish; Minor trend - Turning slightly bullish

Oscillators: Oversold (turning north)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 13.0288/ 11.9954

COPPER (XCU/USD):

Major - Strongly bearish; Minor trend - Turning neutral

Oscillators: Oversold (on verge of rollover into neutral)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 2.235/ 2.092

FxWirePro: Daily Commodity Tracker - 20th March, 2020

Friday, March 20, 2020 11:49 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation